Summarize Content With:

Summary

Filing insurance claims has always been a long shot with tons of paperwork. It is slow and even stressful. Now think if an AI phone assistant can handle the entire process from reporting a loss to settling it within just minutes. It is possible by using AI phone automation. It can cut errors, save time, and deliver a unique experience.

Introduction

For a long time insurance claims have been a time and resources consuming task. It’s complex to navigate the field of insurance claims and then get desired results. But what if the field of insurance is combined with automation through AI phone systems? It can make the process simple, fast and efficient.

This automatic process can take care from start to the end. It can look after each task including intake, assessing the claim and doing payment. Hence the processing time will be lower with less amount of errors.

AI assistants carry out this process efficiently saving both time and money for your business. It also provides a seamless and transparent procedure which enhances customer trust and satisfaction. Let’s learn more about this through the blog.

What is AI powered insurance claim automation?

Unlike the traditional approaches, AI is revolutionizing the way in which insurers deal with claims. It seamlessly carries out the tasks starting from First Notice of Loss to settlement. It further leads to lesser human errors. These AI call assistants can handle the majority of claims automatically without the need of human agents.

- AI can gather and evaluate the information from different channels such as apps, calls or portals.

- The process of FNOL is made faster leading to lesser claim resolution time and better customer experience.

- If the case is complex it is transferred to human agents for personalized support and maintaining data accurately.

As per a research from McKinsey, AI based claim automation can enhance speech by 20%k and operational costs by 40%.

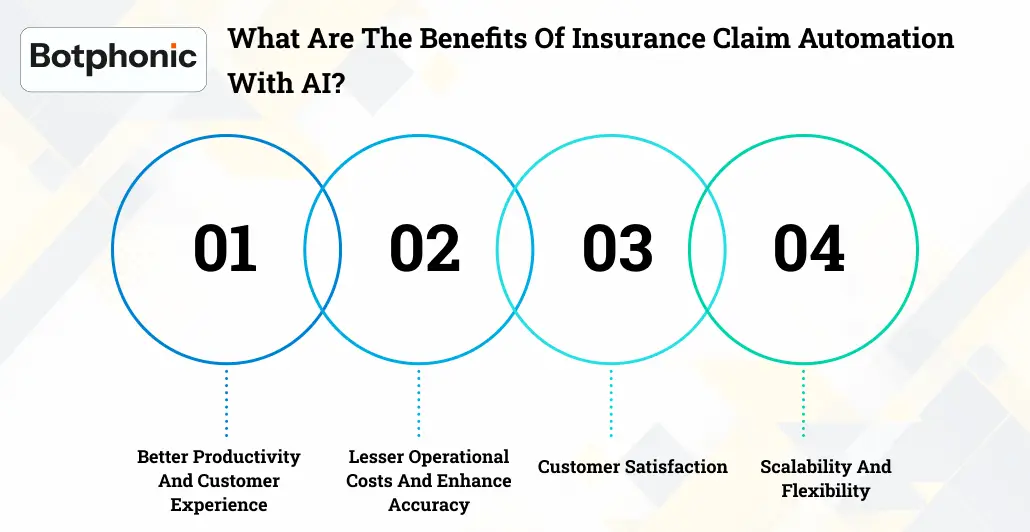

What are the benefits of insurance claim automation with AI?

1. Better productivity and customer experience

Adjusters can seek benefit of AI automation and work only on more complex claim cases. Automating routine claim tasks can enhance productivity of adjusters by 80%. Hence it means quicker resolutions for customers.

- AI powered software can complete simple claims letting adjusters focus on complex inquiries.

- Customers can gain access to faster claim processing along with the round the clock support.

- AI chatbots provide personalized responses so that customers can enjoy their process of claim approval.

2. Lesser operational costs and enhance accuracy

AI automated claim systems are capable of eliminating chances of errors. Further it also reduces the cost associated with it. These automated systems can help insurers to allocate resources properly and efficiently.

- AI can conduct tasks of handling data, validating them and submitting them. It reduces the burden on administration and cuts down on labor costs.

- These generative AI softwares help insurers to enhance efficiency while complying to rules and regulations.

- Botphonic AI’s software can help reduce human errors and enhance data accuracy while claiming insurance.

3. Customer satisfaction

Customer service automation is among one of the top benefits of AI especially in the field of Insurance. It helps customers get real time updates on claims that ensure the process is conducted transparently and faster.

- This software lets customers have an update on their claim status and resolve problems without the need of human agents.

- CSAT scores can be enhanced with AI voice based systems due to quick response times and personalized interactions.

- Efficient and automatic call handling can ensure that customers are satisfied.

4. Scalability and flexibility

These AI based softwares for claim automation are flexible and hence can scale themselves when volume of claims increase. They are either no or low code solutions making the implementation process smooth. It could also save development costs that insurers might have to spend.

- Generative AI software lets insurers scale their operations, handle simpler and even complex tasks.

- These AI systems can easily integrate with your in-house systems for smooth transitions and minimum compromise.

- These systems from Botphonic can easily integrate with CRM for insurers to scale up while not compromising on quality.

Say goodbye to the hassle of endless paperwork – Say Hello to Botphonic AI phone automation!

Request a Free DemoWhat are the necessary technologies that play a crucial role in insurance claim automation?

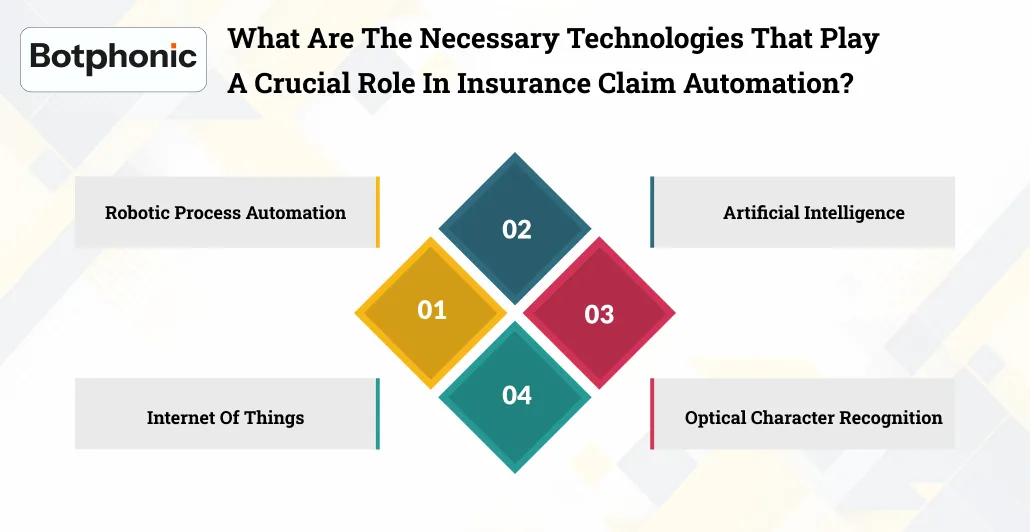

We have looked at the benefits of insurance claims automation. But it’s necessary to know the technology behind it.

- Robotic process automation: It is the system responsible for deploying bots to handle common inquiries and carry out repetitive tasks in a particular manner. In the insurance industry bots are capable of filing claims, extracting specific pieces of information and moving files.

- Artificial intelligence: It is way ahead of Robotic process automation. It can mimic human thinking and perform more crucial tasks. One of the subtypes of AI is machine learning that learns from previous actions to carry out tasks. For insurance companies it can review claim history and detect potential fraud. The second sub part is NLP which provides the ability to understand human language. It makes insurance documents easy to read for both policy holders and insurers.

- Optical character recognition: It is a technology necessary for converting documents such as web pages, notes or receipts into the format that computers can understand. For example this OCR technology can convert a note from a doctor into a document that can be used for claim automation software.

- Internet of Things: It is a physical device that is connected to each other with the help of technology. These days there are smartwatches that store health parameters. It might be used at the time of claim processing.

Key features of an insurance claims AI phone automation system

If you have decided on implementing an AI insurance claim software, here are the features that you must look for:

- First notice of loss: It is necessary for receiving claim notifications and requests.

- Claim validation: Goes through each detail of claims and ensures if it’s complete and accurate.

- Claim decisioning: Decides if the claim has to be approved or not.

- Claim triaging: Sort out claim cases depending on urgency, monetary basis or other factors.

- Damage estimation: Employs different tools or experts to check the cost of a repair or service approximately.

- Claim settlement automation: This technology can sort out simpler and lesser complex claims without minimum need of a human input.

- Task management: Carries out processing of a claim through a specified flow for a person to person and business to business.

- Analytics and reporting: Analyzes data for decoding trends with time which comprises timeframe, claim type, high-touch claims and so on.

- Security and compliance: The automated system will comply with all national and federal insurance regulations. It also ensures the protection of policyholder’s data.

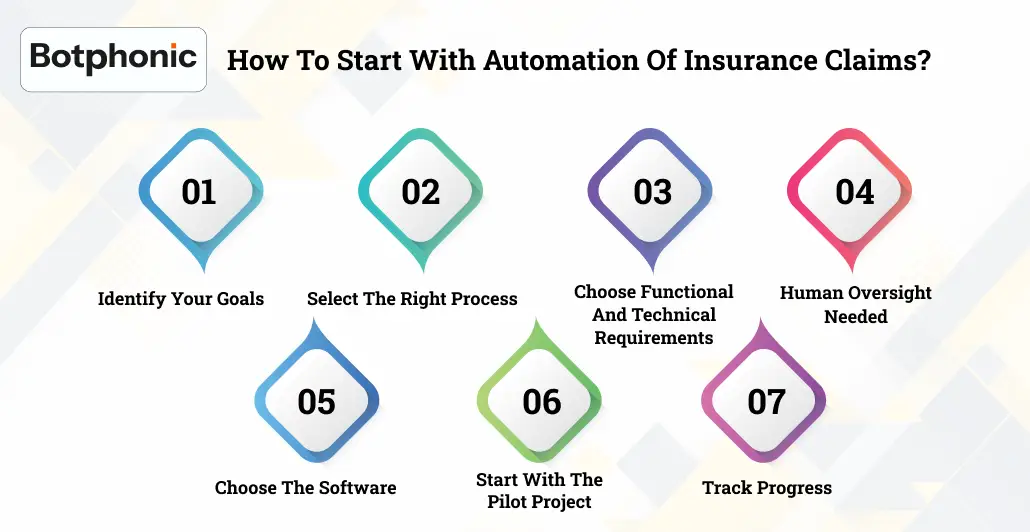

How to start with automation of insurance claims?

Now if you are ready to use insurance claim automation setup ,follow these steps:

- Identify your goals: Check on the need for the insurance claim automation and exactly decide what you want it to do. You can write down measurable goals like reducing claim processing time by 30%. Or it can be providing personalized responses.

- Select the right process: Get in touch with your team and know about your workflow. Check the tasks that are repetitive and routine. And later consider which process can benefit from automation.

- Choose functional and technical requirements: Sir with the in-house IT team to decide software, hardware and storage you need. If you don’t have a strong IT team you can rely on cloud based providers like Botphonic AI to avoid hassle.

- Human oversight needed: Be aware of the human taskforce necessary to deploy and maintain AI insurance claim automation software.

- Choose the software: Complete your research and choose the best vendor possible. Take demos from the vendors before you decide on one. Also come prepared with the questions to be asked.

- Start with the pilot project: You must initially start with a small project and test it. Check what works for you. Hence you will get time to make some adjustments along with implementation. It is the best way to avoid long term commitments.

- Track progress: You must partner with your provider to measure your progress and room for improvement. Get strategies that work and tweak ones that don’t.

Conclusion

Introduction of AI call assistant in the field of insurance claim is automating certain repetitive tasks for good. These solutions ensure to deliver faster, accurate and more reliable results than ever. Automating the majority of insurance claims can ensure lesser human errors, lower costs and round the clock availability for customer support.

Solutions such as Botphonic’s AI can help enhance your claim Processing, improve efficiency and customer satisfaction. With the evolution in the AI and insurance claim industry, it will become an approach towards a friendly insurance experience. By selecting the right partner and solution, you can make processes of claim smooth and easier than before.