Summarize Content With:

Quick Summary

In an insurance agency, traditional receptionists are not capable of offering 24/7 coverage, and even generic AI bots fall short on security. To ensure the inquiry is not missed, whether it’s day or night, you can always opt for an AI receptionist. But did you know, insurance agencies also need to comply with regulatory standards to work effectively. Any call made to an insurance agency might always include some kind of data; it might be personal, medical, or even financial. To save them from getting abused, it’s necessary to know about a secure AI receptionist for insurance agencies.

In this blog, we will be exploring a secure AI receptionist for insurance agencies, its core abilities, and also compliance and security challenges faced by insurance firms.

Introduction

In the insurance sector, trust is not a bonus point that you need to gain but a regulatory mandate. Every client interaction usually involves sensitive data, such as personal information and policy details. As if agencies are racing to modernize their workflow with automation, the question is no longer if they want to adopt AI receptionists, but it’s about how it can be done without compromising compliance. A secure AI receptionist for insurance agencies won’t just help you with call answering, but they will enforce privacy safeguards and will integrate seamlessly with compliance frameworks.

Entering an AI-based virtual receptionist with round-the-clock support, there will be endless cost savings, seamless scheduling, and voice technology that sounds unbelievably human. Let’s get into it:

What is a Secure AI Receptionist for Insurance Agencies?

A secure AI receptionist for insurance agencies is one of the advanced AI-powered virtual assistants that is designed to manage client communications while maintaining strict adherence to insurance compliance and data security standards. These systems are built with end-to-end encryption, compliance auditing, and a privacy-first architecture that helps protect sensitive client data.

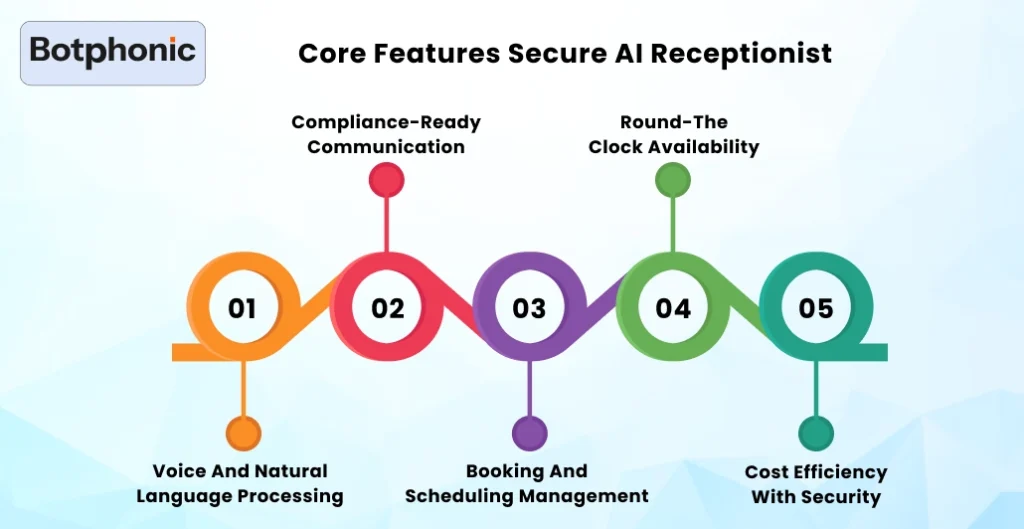

Core Features Secure AI Receptionist

1. Voice and Natural Language Processing

Allows the AI to function as a voice AI receptionist, enabling it to understand client questions naturally and respond to it with near-human clarity.

2. Compliance-Ready Communication

Designed with a mind to align with HIPAA, GLBA, and other state-level insurance regulations.

3. Booking and Scheduling Management

Operates beyond call routing by integrating AI receptionist capabilities for booking management, including policy review, appointments, and claim consultations.

4. Round-the-Clock Availability

Functions as an AI-based virtual receptionist with 24/7 support, ensuring no lead or client query has been missed.

5. Cost Efficiency with Security

Balances AI receptionist cost savings with enterprise-grade compliance features, which allow agencies to reduce staffing costs without introducing regulatory risks.

Unlike industries such as real estate or HVAC, where an AI receptionist bot primarily focuses on booking. A data breach is no longer just limited to damaging clients’ trust, but it can also trigger legal penalties, reputational harm, and loss of licenses.

Compliance and Security Challenges in Insurance Communication

In the insurance industry, every client interaction carries weight. There are casual customer service calls in retail or hospitality. But in insurance companies, communication involves real sensitive data. And that’s the reason why the stakes are even higher; agencies should not only deliver responsive service but also navigate a complex compliance landscape.

Let’s check out some key regulatory frameworks for governing insurance communication:

- HIPAA(Health Insurance Portability and Accountability Act): Protects health-related policyholders’ information, essential for agencies that primarily handle health or life insurance.

- GLBA(Gramm-Leach-Billey Act): Requires insurance companies to safeguard their consumers’ financial data and disclose their privacy practices.

- State-Level Insurance Regulations: This may vary across jurisdictions, but they often make data retention, audit trails, and breach reporting protocols.

Together, these regulations are setting strict rules on how voice AI receptionists, AI call assistants, and virtual receptionist bots are required to handle, store, and transmit data.

Top Compliance and Security Challenges Insurance Agencies Face

1. Unauthorized Access and Data Breaches

AI systems that aren’t built with end-to-end encryption in mind risk exposing their client data during transmission or storage. This could be really dangerous if there’s a voice AI receptionist technology that records calls or transcribes sensitive details.

2. Identity Verification Failure

A traditional AI receptionist bot may struggle in verifying client identity, which in turn creates opportunities for fraudsters to access policyholder data. Insurance agencies are required to have multi-factor authentication layers, which are embedded within AI receptionist workflows.

3. Incomplete Audit Trails

Regulators are bound to demand transparency in their work. If an AI-based virtual receptionist cannot produce clear logs of client interactions, agencies are actively risking non-compliance penalties.

4. Third-Party Integrations

Many agencies use CRM, agency management systems (AMS), and billing platforms. Weak integrations with an AI phone receptionist introduce those compliance gaps. Moreover, it can occur if there is data flow across non-secure APIs.

5. Human-Like Voice Technology Risks

As much as human-like voice technology is helping build trust, it also creates new vulnerabilities. For instance, deepfake exploitation or misleading clients, if AI usage disclosures aren’t made upfront.

The High Cost of Non-Compliance

- Financial Penalties: There are multi-million dollar fines for HIPAA or GLBA violations.

- Reputation Loss: Clients can easily switch providers after knowing their data is being mishandled.

- Operational Disruption: Investigations, audits, and breach notifications can actively paralyze the business community.

Insurance agencies should not treat the adoption of AI call assistant as a simple automation grade. It’s considered a compliance-first decision, where secure AI receptionists are able to choose and balance efficiency, regulatory safety, and trust.

Cross-Industry Lessons: How Other Sectors Use Secure AI Receptionists

Let’s check out how AI receptionists are getting used in other industries and what they teach:

Industry Comparison: AI Receptionist Applications vs. Compliance Needs

| Industry | Common Use Cases | Benefits Realized | Compliance & Security Requirements | Lesson for Insurance Agencies |

| Real Estate | – Answer property inquiries- Schedule tours- Qualify buyer/renter leads | – 24/7 availability to capture leads- Faster conversions- Reduced staffing needs | – Low regulatory burden- Minimal sensitive data shared | Borrow the 24/7 lead capture model, but apply strict data security and authentication for sensitive client info. |

| HVAC & Services | – Service call scheduling- Dispatching technicians- Handling billing inquiries | – AI receptionist cost savings- Optimized technician utilization- Reduced call wait times | – Limited compliance needs- Focus on scheduling efficiency rather than privacy | Adopt the efficiency workflows, but add audit trails and encryption for insurance data handling. |

| SMBs & Clinics | – Call routing- FAQ handling- Appointment booking | – Access to affordable AI receptionists- Consistent client service- Reduced front-office load | – Varies (e.g., HIPAA for clinics)- Often overlooked by small businesses | Insurance agencies can’t compromise; they must choose a secure AI receptionist over “cheap” bots to avoid violations. |

| Insurance | – Policy inquiries- Claims call routing- Agent callbacks- Appointment booking | – Improved compliance management- Lead retention- Enhanced client trust and satisfaction | – Strict adherence to HIPAA, GLBA, and state insurance laws- Encrypted voice/data- Authentication + audit logs | Insurance must lead with security-first adoption: combine efficiency gains with robust compliance protections. |

Opt for Botphonic AI today, which offers 24/7 availability, meaning no longer missed calls, no missed consultations.

Try Botphonic Now!Conclusion

For insurance agencies, adopting AI receptionists for insurance claims is not a small step towards efficiency, but it’s a matter of compliance, security, and client trust. While other industries like real estate and HVAC prioritize convenience and cost savings, insurers prioritize higher standards. Every interaction with an insurance company involves sensitive personal and financial data. Due to this, making a secure AI receptionist for insurance agencies is the only viable option.

Integrating voice AI receptionists with requisite features such as end-to-end encryption, compliance-ready communication logs, and even advanced booking management allows agencies to gain the best of the world.