Summarize Content With:

Summary

We discuss the top AI call software for banks & FinTech in this blog, compare the main competitors, and give reasons why Botphonic.ai is a leading choice. We explain the features, benefits, and real-world use cases and offer practical advice for selecting and implementing voice AI in your bank or financial institution.

Key Takeaways

- AI phone agents deliver a 24/7 service that is more comfortable and less expensive for banks and fintechs and is also scalable.

- Botphonic is different from the rest with its no-code installation, fast human-like voice, sentiment analysis, integrations, and reliable data security.

- First of all, banks can determine regulatory compliance through their AI call software by considering regulatory requirements, voice quality, integration capabilities, and cost structure.

Introduction

Suppose that your bank receives a call from a customer at midnight who is anxious about a transaction he didn’t authorize. Instead of being put on hold, the customer speaks to an empathetic human voice. But the voice isn’t a human; it’s an AI. The AI, even though it does not sleep, empathizes, collects information, routes it, and finally helps.

Banks and FinTechs have to deal with the following situations: increased call volumes, the high cost of providing 24/7 customer service, security and compliance risks, and customers who demand fast, human-like interactions. AI phone call software is the perfect answer to those problems. We will explain in this blog why voice AI is important in banking, analyze the competition, and demonstrate how Botphonic.ai can help financial institutions grow not only securely but also smartly.

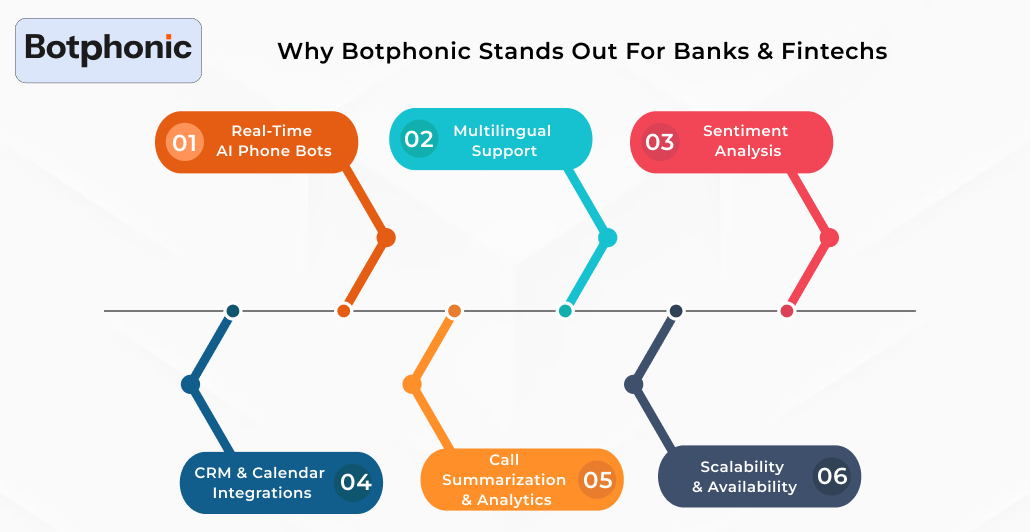

Why Botphonic Stands Out for Banks & Fintechs

After checking out the competitors, we should now explain the reasons why Botphonic.ai can be the best AI phone call software for banking and financial services.

Core Features That Matter

1. Real-Time AI Phone Bots

Botphonic uses ASR, NLP, dialogue management, and TTS to handle multi-turn, real-time conversations, and it accomplishes this within seconds, thus it is one of the top ai phone call software for banks.

2. Multilingual Support

Botphonic supports 20+ languages. It can even detect which language the caller is using and can answer in that language.

3. Sentiment Analysis

The system identifies the user’s sentiment, mood, and even frustration level using NLP. When callers sound angry or upset, the AI can escalate or route the calls to people.

4. CRM & Calendar Integrations

Botphonic can work with Google Calendar, Outlook, and CRM platforms, thus enabling it to schedule appointments or fetch customer records.

5. Call Summarization & Analytics

After each phone call, Botphonic creates summaries. Along with it, the company also collects sentiment data, transcripts, and conversation analytics.

6. Scalability & Availability

According to Botphonic, the firm can manage hundreds of calls at a time, with no more than 500 ms latency, and is available 24/7.

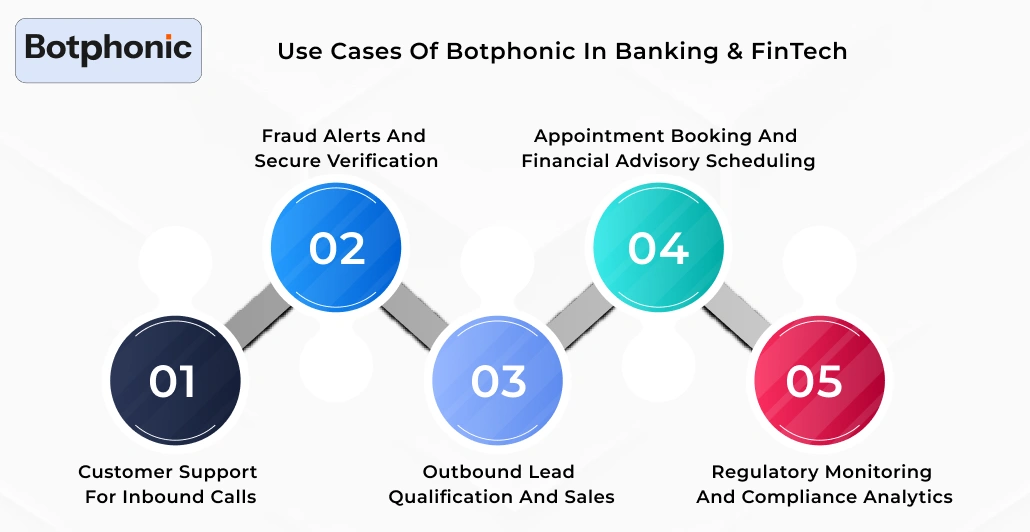

Use Cases of Botphonic in Banking & FinTech

1. Customer Support for Inbound Calls

Using Botphonic, a company can easily handle a massive number of customer calls while keeping conversations smooth and natural. Without any hesitation, the system provides prompts to the users about balances, cards, loans, and branch details.

If detectable anger is present, even in the slightest, the call is immediately transferred to a human agent, thereby easing the customer’s stress. To make the process even faster, the transcripts generated from the calls are also made available to the support teams so that they can take up the work from there.

2. Fraud Alerts and Secure Verification

The technology behind Botphonic uses quick, secure questions to verify a caller’s identity. It gathers fraud details and quickly updates the steps for handling the fraud that you set.

If a case requires human intervention, the system will notify the fraud department. In addition, the bot is always ready to help, keeping data safe by encrypting and storing all conversations.

3. Outbound Lead Qualification and Sales

Botphonic is programmed to call the leads on your list and ask straightforward questions to determine their eligibility. The collected information enables the team to understand each potential customer’s needs thoroughly.

The qualified leads are looking for help closing sales, so they are sent directly to the representatives along with full call summaries. Besides that, the conversion rates go up even more as the process stages get to the unqualified leads who are filtered out early.

4. Appointment Booking and Financial Advisory Scheduling

There is no need for your team to check each other’s availability, as Botphonic can handle it and still book appointments instantly. If a customer wants to cancel a visit or reschedule the meeting, Botphonic would be glad to do so.

By accepting the scheduling, employees help reduce the load on their manual work, which is actually handled by the bot. Along with that great work, the bot is also achieving a high level of customer satisfaction by offering speedy, trouble-free bookings.

5. Regulatory Monitoring and Compliance Analytics

Botphonic is designed to log each conversation, not only with words but also with emotions recognized by the system. The company identifies any customer interaction that may require compliance verification or extensive scrutiny.

Transitioning with your audit process provides support through accurate records and easy-to-understand summaries. Most importantly, it is giving your team the right tools to always be one step ahead of risk and, at the same time, improving communication quality throughout the journey.

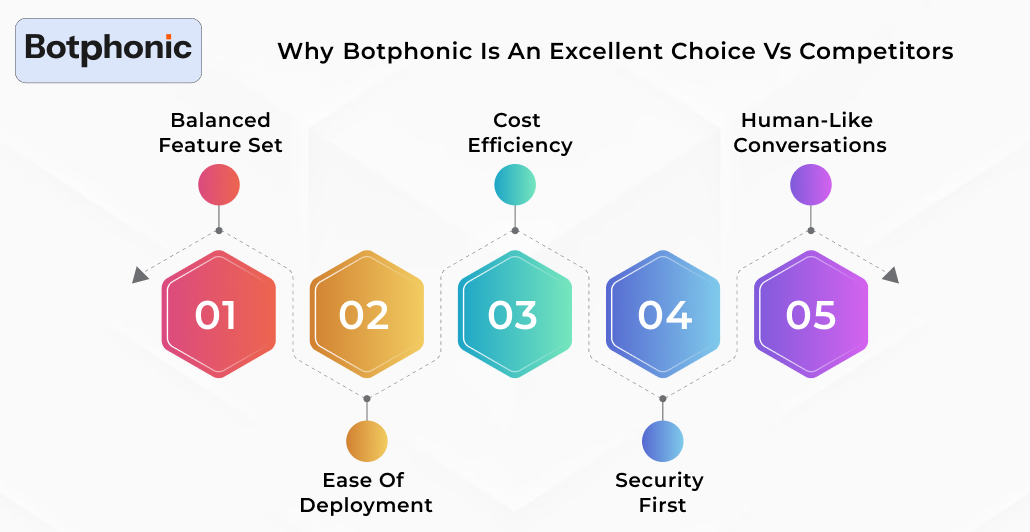

Why Botphonic is an Excellent Choice vs Competitors

As the first step, we have examined the competitors. Now we demonstrate the reasons why Botphonic is among the most powerful AI call assistant solutions for banking and financial services.

- Balanced Feature Set: Botphonic offers a good combination of features: voice AI + analytics + automation, whereas other platforms may focus only on one aspect, such as voice stack (Telnyx) or analytics (VoiceSpin).

- Ease of Deployment: The no-code builder feature, which is user-friendly for non-technical teams, helps in cutting down the time from the conception of the idea to the live agent.

- Cost Efficiency: A great saving of the human agent expenses if the AI-powered voice agent, which is capable of handling routine calls, is operated 24/,7 is the main point of this technique.

- Security First: Botphonic is equipped with features required for implementation in highly regulated industries such as finance because it is compliant with standards like PCI DSS & GDPR.

- Human-like Conversations: Since Botphonic focuses on the naturalness of voice, sentiment, pause, and tone, it sounds real to customers, thus trust gets enhanced.

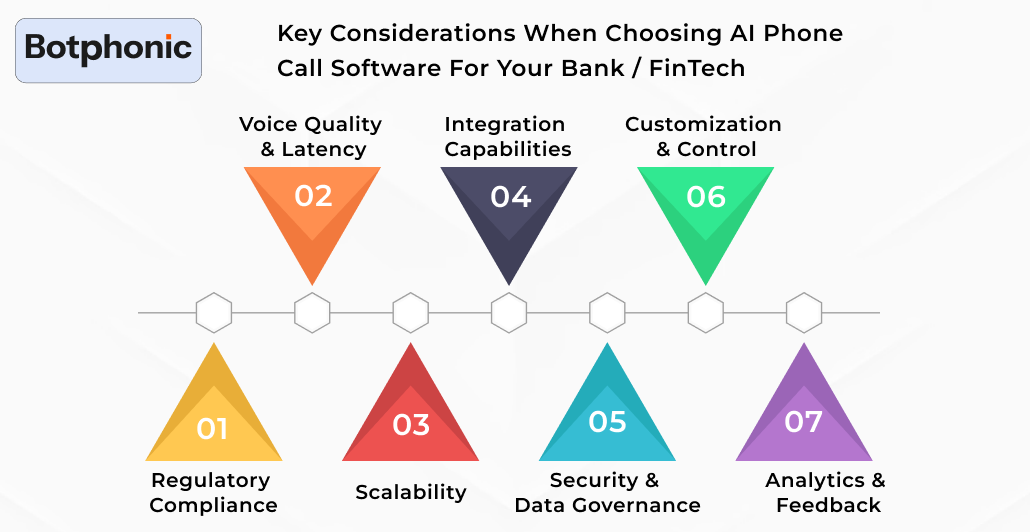

Key Considerations When Choosing AI Phone Call Software for Your Bank / FinTech

While deciding on a voice-AI provider, there are certain requirements to be met that can provide a bank/fintech context:

1. Regulatory Compliance

- Is the vendor compliant with PCI DSS, GDPR, or other relevant frameworks criteria?

- Are the calls that are recorded encrypted, and who is permitted to access them?

2. Voice Quality & Latency

- Is the AI voice lifelike (tone, gender, pauses)?

- What is the speed of the response? Does latency interfere with the conversation?

3. Scalability

- Is the solution able to cope with increased demand for calls (e.g., fraud spikes, billing)?

- Can it be scaled horizontally (more bots, multiple markets)?

4. Integration Capabilities

- Is it capable of integration with your CRM, calendar, and core banking system?

- How simple is it to get or send data (customer info, meeting slots, call logs)?

5. Security & Data Governance

- What data is kept and in what manner?

- Are there measures for audit logging and voice authentication?

- Is the vendor performing penetration testing?

6. Customization & Control

- Are you allowed to create your own conversational flows?

- Does the AI have the capability to use domain-specific knowledge (finance, banking)?

7. Analytics & Feedback

- Is that helping with emotion recognition and generating call summaries?

- Are You Able to Track the Performance Indicators Such as Call Containment, Escalation Rate, and Handoff Success?

Your team is spending valuable time on repetitive calls that AI can take care of in no time. Why not provide your bank or fintech with the power of 24/7 intelligent voice automation? Schedule a live demo and experience Botphonic’s performance firsthand at Botphonic

Try Today!Conclusion

The transition of AI-driven calling applications is a reality. Customer service voice AI in banking and financial institutions is a treasure: it can answer customer queries 24/7, reduce business operating costs, ensure regulatory compliance, and even deliver a customer experience that is friendly and high-quality.

Furthermore, in case your organisation is looking for AI phone call assistant for financial advisors, Botphonic is able to make the whole process of advisory scheduling, client qualification, and creating communication flows that are compliance-ready as simple as a breeze.

Don’t try to conquer the world in a single step; start with a small experiment, evaluate quickly, and then move forward with confidence. With Botphonic, turning to AI-powered calling will be not only your operational and regulatory compliance advantage but also smooth and strategically valuable.