Summarize Content With:

Summary

This blog explores the role of AI phone calls in the banking and finance sector as a customer service game-changer. We detail how a voice-enabled AI assistant like Botphonic operates, the core benefits, application scenarios, challenges, and the ground realities of best practices.

Key Takeaways

- AI phone calls offer nonstop support that is scalable and almost indistinguishable from human interaction, and thus reduces expenses and enhances the level of customer satisfaction.

- In banking, voice-based AI can interact with customers to handle simple queries (balances, alerts), spot fraud, and perform personalised upselling.

- The introduction of AI into phone-based customer service goes hand in hand with the need to ensure data security, comply with regulations, and make the transition to a human agent seamless.

- By using Botphonic’s AI call assistant, finance companies can roll out the most effective, safe, and fast voice agents to not only improve the customer experience but also reduce operational costs.

Introduction

What if you needed to call your bank at 12 a.m. and the person who answered was a friendly voice that sounded like a human? That voice already knows your name, gets your question quickly, and fixes it without putting you on waiting line after waiting line. You aren’t aware that you’re actually interacting with AI. This is no longer a futuristic vision; an AI phone call in banking and finance is turning into reality.

For a company like Botphonic, focused on AI-powered voice assistants, the trend is precisely the kind of breakthrough that can completely change the way banks engage with their customers. In this blog, I will explain the meaning of AI phone calls in banking, why they are essential, how they operate, and how Botphonic can assist institutions in modernising customer service .

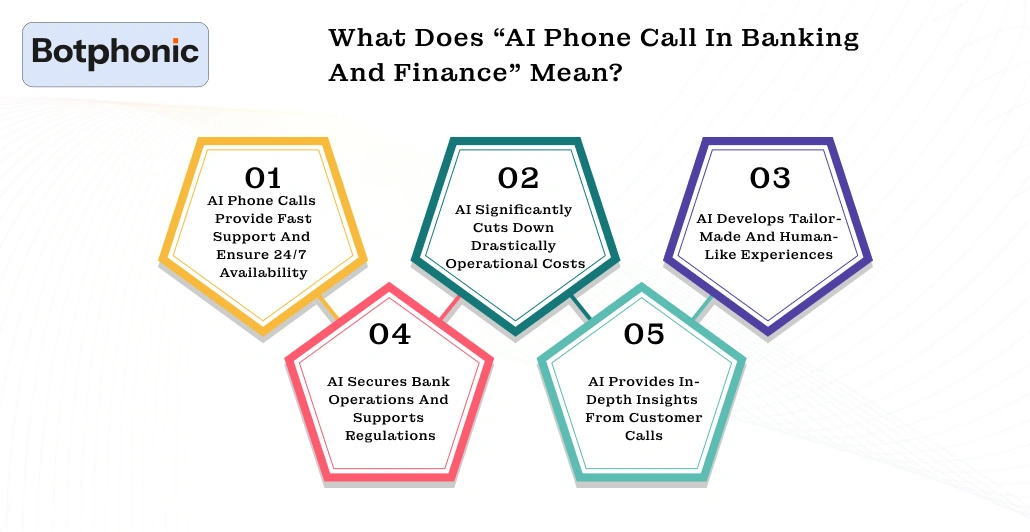

What Does “AI Phone Call in Banking and Finance” Mean?

1. AI Phone Calls Provide Fast Support and Ensure 24/7 Availability

Customer calls are responded to immediately by AI, eliminating long waiting times. Also, as it operates 24/7, customers can get help at any time of the day or night. To support the never-ending service, banks thus offer a more comfortable customer experience.

2. AI Significantly Cuts Down Drastically Operational Costs

While AI can handle thousands of calls, a large call centre team is not necessary. Banks are saving money by avoiding the costs of recruiting, training, and caring for personnel in the customer support department. The optimally functioning bank has high efficiency and thus allocates resources to higher-priority tasks.

3. AI Develops Tailor-Made And Human-Like Experiences

Artificial intelligence digs deep into customer history and, technically, can even anticipate their needs within the next few minutes. In a friendly, natural voice, it talks to customers as if it were a person. Customers gain a better understanding, and in every interaction, they feel more appreciated.

4. AI Secures Bank Operations and Supports Regulations

First of all, AI complies with the most stringent rules governing the banking sector, and at the same time, it is very thorough in all the required confirmation steps. Through secure authentication, it also lessens fraud by implementing smart checks. Banks are on the safe side in terms of compliance, as AI continually operates with precision and accuracy.

5. AI Provides In-Depth Insights From Customer Calls

By reviewing every call, AI can spot patterns in customers’ behaviour, frequently raised problems, and mood. Banks get this information, from which they can enhance the quality of their services, eliminate the issues, and draft better plans. The team with this information has the means to make decisions swiftly and wisely.

Learn more: 5 Real-Life Examples of AI Phone Call Automation

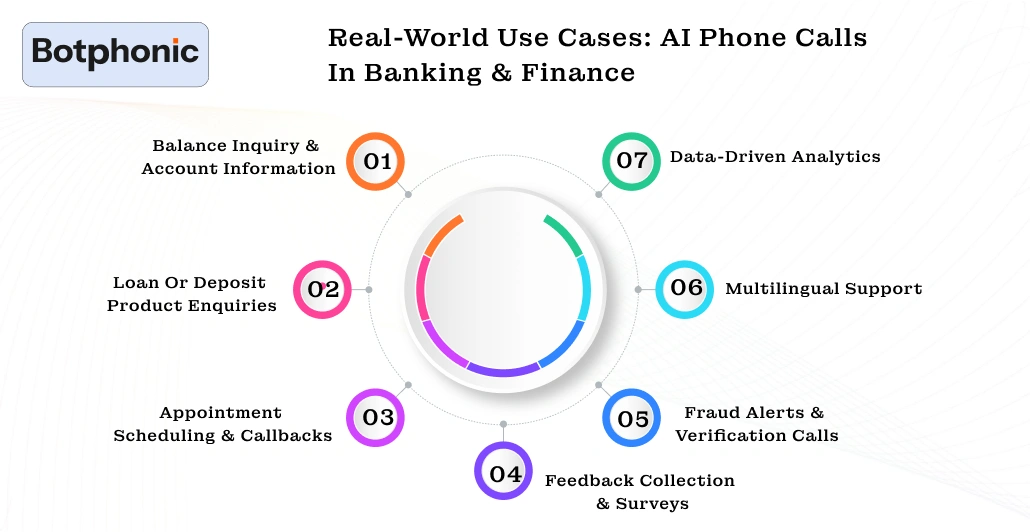

Real-World Use Cases: AI Phone Calls in Banking & Finance

To comprehend the functionality of AI phone calls in real banking situations, we can delve into the examples of typical scenarios and see how Botphonic can be a source of value.

1. Balance Inquiry & Account Information

One of the customers, who may be asleep or busy during the day, calls the bank’s support line at midnight to check his balance or account transactions. The AI voice assistant, however, attends to the customer, requests confirmation (via voice or a quick verification), obtains the data, and then delivers it appropriately. The assistant can also send the bank statement to the person by mail or message if they desire.

2. Loan or Deposit Product Enquiries

A potential customer needs to be informed of the bank’s fixed deposit features or loan interest rates. The AI can present different products to the customer, inquire about certain details (term, amount), and book a call with the manager at a later time to further guide them.

3. Appointment Scheduling & Callbacks

Customers telephone to arrange a meeting with a bank officer or ask for a return call. The AI voice assistant communicates with the bank’s calendar system, confirms availability, and then schedules a time. The voice then indicates the appointment, and if the user wishes, an SMS or email reminder is sent. Botphonic allows calendar management in this way.

4. Feedback Collection & Surveys

After a call or banking service interaction, the AI invites the customer to provide feedback via voice (e.g., “Please, give a rating from 1 to 5 for your experience”). It gets, holds, and evaluates that feedback. In particular, Botphonic is equipped with a built-in feedback collection system.

5. Fraud Alerts & Verification Calls

Upon detecting a suspicious transaction, AI phone agents could call a customer to confirm the activity (“Were you the one who did this?”). Because the voice sounds natural, customers therefore trust it and respond more quickly.

6. Multilingual Support

The AI voice assistants that support multiple languages can be a great help to banks whose customers speak different languages. Botphonic’s Multilingual services can manage calls in more than 20 languages.

7. Data-Driven Analytics

Every call is transformed into a data point. The AI provides call transcripts, performs sentiment analysis, and generates summaries of action items. Botphonic offers features such as conversation analytics and summarization 36% of banks have introduced AI-enabled voice assistants .

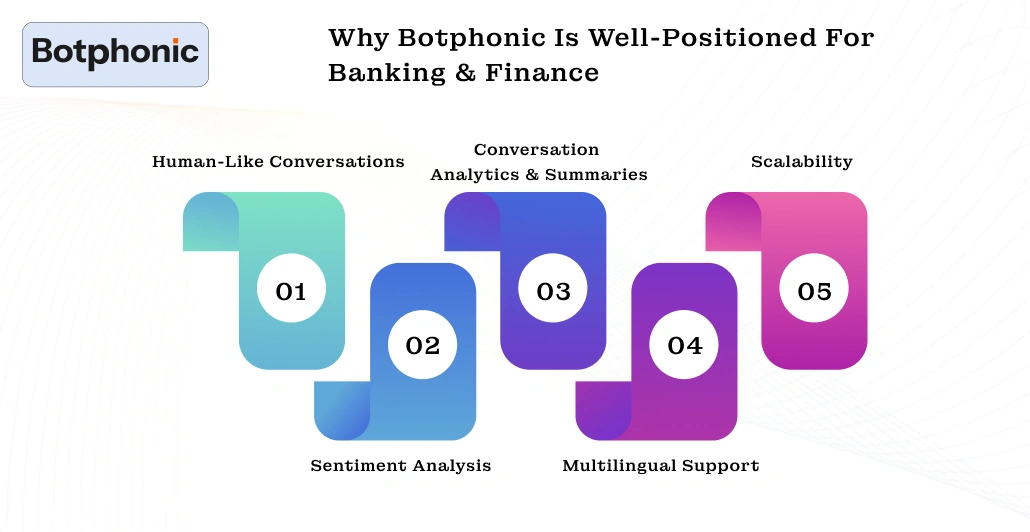

Why Botphonic Is Well-Positioned for Banking & Finance

Since the banking sector is quite complicated and strictly regulated, not just any AI voice platform can be used. However, Botphonic comes with several advantages that make it an excellent option for financial institutions.

Due to the complicated and heavily regulated nature of the banking sector, not every AI voice platform fits the bill. However, Botphonic offers several features that make it a preferred option for financial institutions.

1. Human-Like Conversations

Botphonic’s AI call assistant can carry out a conversation in a very natural manner, mimicking a discussion between two people. In general, users cannot distinguish the bot from a human. Such a feature is indeed instrumental in building confidence, especially when interactions in the banking sector are sensitive.

2. Sentiment Analysis

Botphonic employs sentiment analysis driven by Natural Language Processing (NLP). It not only understands customer emotions but also changes its wording accordingly – offering empathy if customers are angry or giving reassurance when necessary. This feature is a lifesaver in a bank, where it is very important to take good care of customer emotions (for example, anxiety about transactions, security, loans, etc.).

3. Conversation Analytics & Summaries

Upon request, Botphonic can generate a brief of the call it just had. It records the most important topics addressed, any points that need to be followed up on, and the customer’s mood. With this tool, banking personnel can review key talks quickly and then decide on the appropriate course of action.

4. Multilingual Support

Botphonic can communicate in over 20 languages, making it a perfect fit for banks with customers from diverse cultures and societies.

5. Scalability

Day after day, Botphonic can handle hundreds of calls without breaking a sweat. As the number of calls rises, it will be there to handle the increase without the need to recruit more human staff.

With 24/7 voice AI, your bank stays always on without hiring extra staff. Try Botphonic now with a risk-free trial and feel the difference.

Try a Demo Free!Conclusion

AI-driven phone calls for banking and financial services used to be only a futuristic concept they have become an indispensable part of customer support in the present time. Through sophisticated AI phone call solutions, financial institutions are able to offer interactions that resemble those with a human, free up their staff from repetitive work, provide service round the clock, and at the same time, keep up with regulations and security measures.

Botphonic is leading this change. With almost human conversations, sentiment analysis, analytics, multilingual support, and strong security, Botphonic provides an attractive solution for the digital banking world.

If you want to upgrade your customer service to be more intelligent, more productive, and always available, use Botphonic.