Summarize Content With:

Summary

In this blog I will cover the best AI receptionist for insurance agencies , key features, vendor strengths and how these technologies are redefining the future of the insurance industry. AI receptionist adoption is growing rapidly in 2025. An AI receptionist improves lead capturing, reduces operation costs, creates strong compliance and takes customer satisfaction to the ultimate level. With natural language understanding and industry-specific expertise, AI systems efficiently handle routine work such as handling policy-related inquiries, insurance claims processing and appointment scheduling so that human staff can focus on complex cases and client relationship building. My objective is straightforward: I want to assist insurance companies in preventing missed calls and delays so they can offer their clients quick, safe, and dependable services by using AI receptionists. Let’s begin!!!

Introduction

In the insurance industry, every customer encounter is crucial, particularly when handling a claim or a stressful situation akin to an accident. AI receptionists are completely transforming the insurance industries. Formerly, the insurance industry was dependent on live staff for answering calls, scheduling appointments, and handling inquiries. As the number of calls rises, customers anticipate timely resolutions and round-the-clock service availability. How will you deal with such customers in 2025? This is where the AI receptionist’s power lies! AI receptionist provides you round-the-clock services, instant response and seamless integration with agency management services.

As we know, Insurance agencies struggled with overflowing lines and long hold times and frustrated clients. Even my insurance agencies struggled with this phase; claims went unanswered and valuable clients walked away. Last month my insurance firm encountered a loss of $30000. Then finally we adopted AI receptionist software. In 2025, an AI receptionist is not a luxury but a secret weapon for business growth and client satisfaction. AI receptionists ensure that no calls get missed and urgent queries immediately get addressed, and routine requests get handled empathically. AI agents empower insurance agencies to deliver superior customer experiences, optimize the resources and stay abreast of the competitive edge.

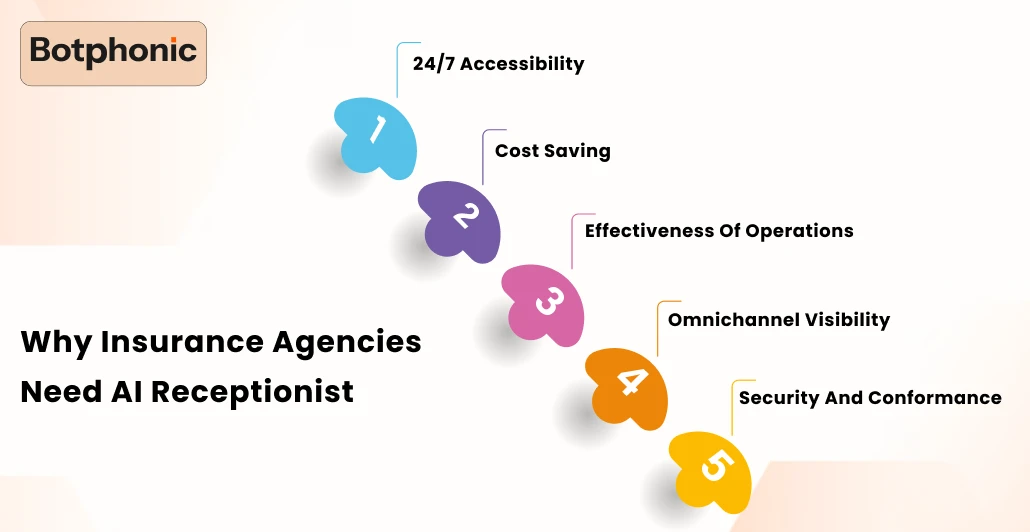

Why Insurance Agencies Need AI Receptionist

Let’s check out:

1. 24/7 Accessibility

In the Insurance world, every call is important. But human reps are not available after business hours; their work time is limited. An AI receptionist can be a game changer in this situation. It manages all the calls and texts and chats and provides prompt responses to customers. Also, ensure the insurance business never misses out on exciting opportunities coming their way.

2. Cost Saving

Running a traditional call center was highly expensive, and extending your team during high-volume call scenarios took a huge amount of time. Ai receptionist handles multiple calls at a fraction of the cost. It handles all of the repetitive and fundamental duties performed by human employees, which were time-consuming and ineffective. Now, human staff can focus on complex and critical tasks. It saves the company budget and time on repetitive tasks.

3. Effectiveness of Operations

AI receptionists can automate mundane and laborious tasks of humans, such as follow-ups, scheduling, claims updates, policy renewals and lead qualification. With ai agents , you can avoid wasting time on unproductive tasks and can spend your energy on high-value tasks and strategic work. It helps you optimize the efficiencies and productivity of your insurance agencies.

4. Omnichannel Visibility

Nowadays, customers are not choosing a single platform to interact with your insurance business. They opt for multiple platforms such as phone, chat, messenger, instagram, facebook. If your insurance business is unavailable on these platforms, you may lose your customers. But the good news is that you can deal with customers on multiple platforms with the help of an AI voice assistant. Ai agents can seamlessly integrate with multiple channels and provide a pleasant and uninterrupted experience to customers on all platforms.

5. Security and Conformance

Data security and compliance are the highest priorities of the insurance industry. Adhering to compliance at every stage is practically impossible in the traditional system; agents can often make mistakes, and you could eventually run into legal issues. But with an AI receptionist, you don’t have to be concerned about considering compliance.

Advanced AI solutions are adept at HIPAA, SOC2 and industry-specific protocols and strictly follow them in every step, which is not 100% accurate with human staff. AI agents keep the client information encrypted from third-party access, saving insurance businesses from getting into legal problems in the future.

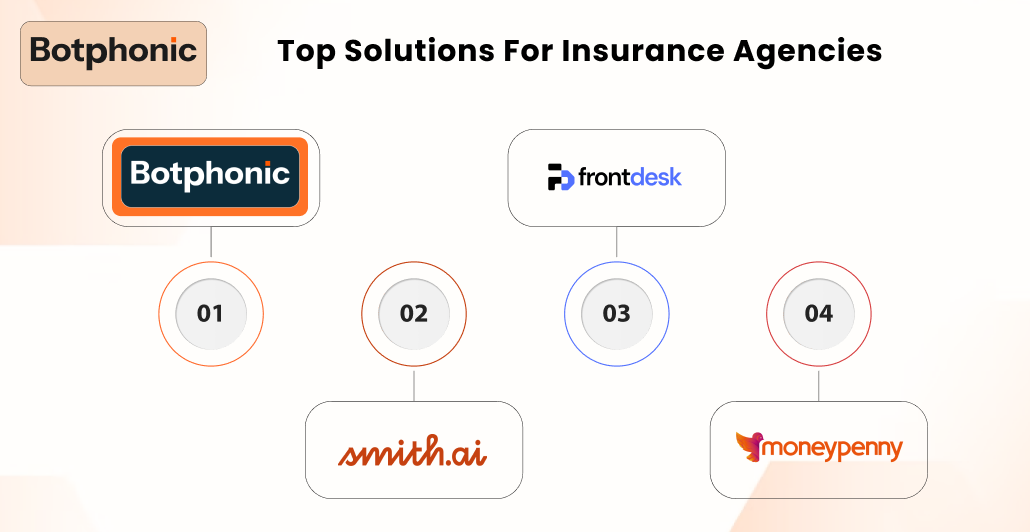

Deep Dive: Top Solutions for Insurance Agencies

Let’s check out:

1. Botphonic AI

Why does it stand out?

In 2025, Botphonic AI will become a top choice for US insurance brokers. Its natural language processing and real voice capabilities provide a human-like experience to clients. With omnichannel reception and insurance workflows, botphonic offers the deepest integration. Botphonic insurance-trained bots instantly qualify the lead and send policy details, schedule callbacks and claims updates and escalate the urgent cases to licensed agents. This automatically updates in the agency management system.

Key features

- Advanced NLP for policyholder interactions

- Integration with Salesforce, HubSpot, and AMS platforms

- HIPAA/SOC2 compliance and secure call transcriptions

- Real-time analytics dashboard and sentiment scoring

- Multilingual, scalable plans for large or multi-office agencies

Best for: Mid-sized to large insurance agencies, MGA or brokers looking for front desk automation without compromising compliance and regulation.

Upgrade your insurance agency with a smart Al receptionist.

Free Demo2. Smith AI

How does it stand out?

Clients were not happy with the way we handled their calls under the old system. They claimed that their concerns were not getting proper attention and mostly my team provided delayed responses to clients. This loses the trust and the overall customer experience becomes too untrustworthy. Are you struggling with providing prompt responses to your customers? Smith ai is a hybrid model that perfectly bridges the gap. AI handles mundane calls but for resolving complex queries, dealing with high-value leads and regulatory exceptions, human specialists step in and provide personalized and accurate solutions to customers.

Key features

- 24/7 AI-first answering with human fallback

- Lead screening or qualification

- Appointment scheduling or payment intake

- CRM/platform integrations

- Multilingual support and flexible pricing

Best for: Agencies that want both automation and trusted human touch in their operations. Smith ai is ideal for specialty lines, legally heavy policies, and high-net-worth insurance shops.

3. My AI Front Desk Software

Why does it stand out?

Small insurance agencies and independent agents are often struggling with managing client calls and the front desk. Customer trust can sometimes be lost as a result of missed calls and delayed responses. My AI front desk software helps insurance agencies to fill this gap efficiently.

It is easy to configure; you don’t have to take hassles for technical considerations, and the pay-as-you-go features make it an ideal option for small teams. Customizable call scripts ensure personalized and professional client interaction.

Key features

- Instant online setup (no IT skills needed)

- Custom greetings, localized branding

- 24/7 call and SMS coverage

- HIPAA-compliant data handling

- Designed for solo and small teams

Best for: Small and mid-sized insurance agencies seeking low-cost, scalable, easy-to-use front desk automation without forfeiting the client experience.

4. Moneypenny

How does it stand out?

Insurance agencies that handle bilingual and nationwide clients struggled with providing a smooth and personal touch in every client interaction. Customers feel their concerns are not properly addressed and insurance agencies’ reach seems limited. Moneypenny ai receptionist perfectly fills this gap. With Industry-leading multilingual support and generative AI, it provides both a local-personal feel and enterprise reach.

AI agents seamlessly hand off to deliver consistent and efficient client support to bilingual brokerages or nationwide providers. Further, by applying moneypenny ai receptionist in workflows, clients feel valued; they feel you are prioritizing their languages and preferences. It helps you provide smooth and professional services, ultimately boosting your brand reach and credibility in the dynamic marketplace.

Key features

- Multilingual AI conversation

- Smart handoff to human specialists

- Customizable workflows for claims and renewals

- Secure data storage and compliance monitoring

- Custom plans for complex enterprise needs

Best for: Moneypenny AI receptionist software is a perfect option for agencies in multicultural communities or national players with diverse client bases.

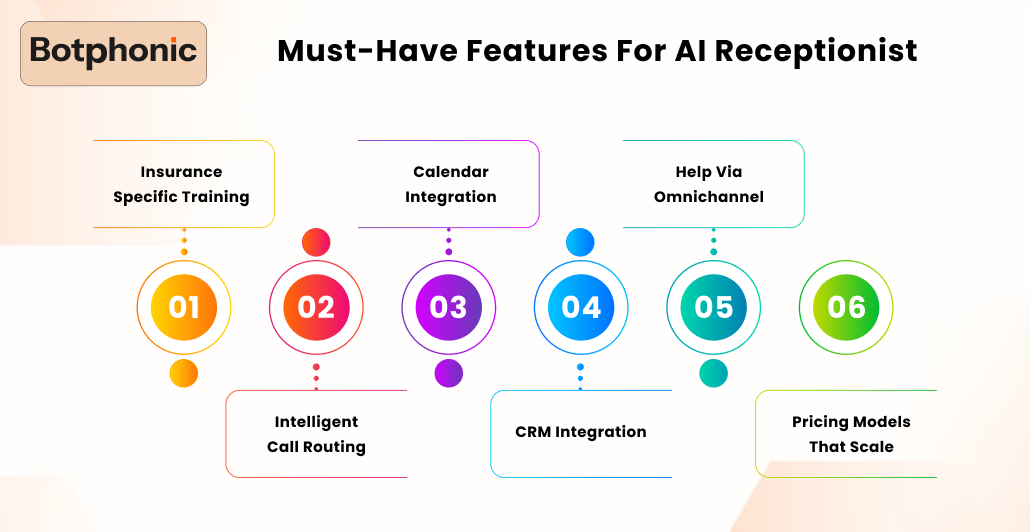

Must-have Features for AI Receptionist

Let’s find out:

1. Insurance-Specific Training

An AI receptionist should be proficient at understanding insurance terminology and common questions and workflows deeply to make every customer interaction smooth and accurate.

2. Intelligent Call Routing

Handling every call is an imperative aspect for insurance agencies. Clients get frustrated if responses get delayed or redirected to the wrong department. Intelligent call routing ensures customer emails, calls, texts, and chats get transferred to the right agents. In order to continue providing seamless and expert customer experiences, intelligent algorithms analyze each customer interaction and assist businesses in making decisions in real time.

3. Calendar Integration

Human agents have tight schedules. AI call assistant with calendar integration synchronize the customers’ real-time appointment booking. reminders and reschedules and updates the same in the system so that agents do not skip out on important follow-ups.

4. CRM Integration

If your customer data is scattered, it is difficult for insurance businesses to analyze the performance. CRM integration ensures all the data and records instantly get updated so that agents get a complete profile of customers during the calls.

5. Help via Omnichannel

Nowadays clients are not dependent on only calls; they raise their queries on multiple platforms like chats, messengers, instagram and more. They expect agencies to be available on every platform. Omnichannel AI receptionists can effortlessly handle calls, chats texts, sms from different platforms through a unified dashboard. AI agents help insurance agencies track every interaction; no queries get slipped out and customers feel you are providing them special attention.

6. Pricing Models that Scale

Small insurance agencies’ and large national brokerages’ needs are different. But an AI receptionist caters to the need for both. With flexible pricing models, you can start from a small setup and scale your features effortlessly as your business evolves. With flexible pricing models, you need to pay as per your usage and also it avoids any bottlenecks in future expansion.

Comparative Overview

| Platform | 24/7 Service | Compliance | CRM Integration | Call Routing | Multilingual | Pricing (2025) | Best For |

| Botphonic AI | Yes | HIPAA, SOC2 | Yes | Advanced | Yes | Flexible plans | Scalable, insurance-specific |

| Smith.ai | Yes + Human | Secure | Yes | Advanced | Yes | Tiered pricing | Agencies needing human escalation |

| My AI Front Desk | Yes | Secure/HIPAA | Yes | Smart | Yes | Pay-as-you-go | Small agencies, fast setup |

| Moneypenny | Yes | Secure | Yes | Smart handoff | Yes | Custom | Global agencies, language support |

Conclusion

In 2025, leading US insurance agencies recognize that every missed call can mean a lost policy, a dissatisfied client, or a compliance headache. The best AI receptionist solutions—like Botphonic AI, Smith.ai, and My AI Front Desk—help agencies remain agile, competitive, and client-centric, no matter their size. For agencies serious about growth, efficiency, and future-proofing their client relationships, putting investment in a leading-edge AI receptionist is not just smart; it’s necessary.

I hope the blog post above gives you helpful information about the top AI receptionist for insurance claims and how to streamline your daily insurance operations.

Still having doubts? Connect with Botphonic!!!!