Summarize Content With:

Summary

The new era of banking service is here and it speaks AI. From answering calls within an instant to remembering what clients prefer and integration with CRMs, AI receptionists are making front desk operations smarter. These are your always-on assistants for making customers satisfied. This blog will help you know what these assistants mean to banks, how they save costs and explore some best AI receptionist tools for bank customer service.

Introduction

Imagine what it would be like to walk into the bank five years from now. No more waiting in a long line, not repeating your account number multiple times and being on hold. Rather an AI receptionist picks your call and greets you instantly. Additionally it is aware of your preferences, understands the tone of your conversation and solves your query even before you have completed telling it. In actuality, the future is now here and won’t be five years from now.

The best AI receptionist tool for bank customer service is not all about upgrading from a traditional front desk but reimagining how banks manage their operations. Unlike those IVRs with fixed and rigid menus that have useless options, today’s AI receptionists are more empathetic, multilingual and seamless. They save you money, lessen the likelihood of missed calls, and personalize banking.

But the question is how fast are banks adopting the usage of these modern AI receptionists? Let the text’s data do the talking. Also this blog will uncover best choices of AI receptionists for the banking sector.

Understanding AI receptionist for bank customer service

Banking has come a way longer than just being about numbers and transactions. It’s now all about delivering best, fast, seamless and personalized services. The traditional role of front desk operations is now being taken over by the modern day AI receptionists. They are capable of handling multiple queries at once with the same enthusiasm, schedule appointments and even respond to everyone with human fluency. Natural language processing and machine learning enable these virtual assistants to comprehend context and learn about users’ preferences. This high end technology further caters as per clients preferences making automation feel personal.

Here’s a list of real world statistics to help you understand better

- As per a survey from Gartner, usage of conservational AI in customer care is thought to reduce labor costs by USD $80 billion across the globe by 2026.

- As per a study on satisfaction of banking customers, adopting AI receptionists has led to an increase of 15% of customer satisfaction and 25% enhancement in transaction times.

- It is reported that firms using AI powered chatbots for customer inquiries can reduce operational costs by 30% with an increase in customer retention by 25%.

These statistics might have made it clear how beneficial it is to adopt the best AI receptionist tool for bank customer service. They save costs, minimize errors, gain customer trust and loyalty.

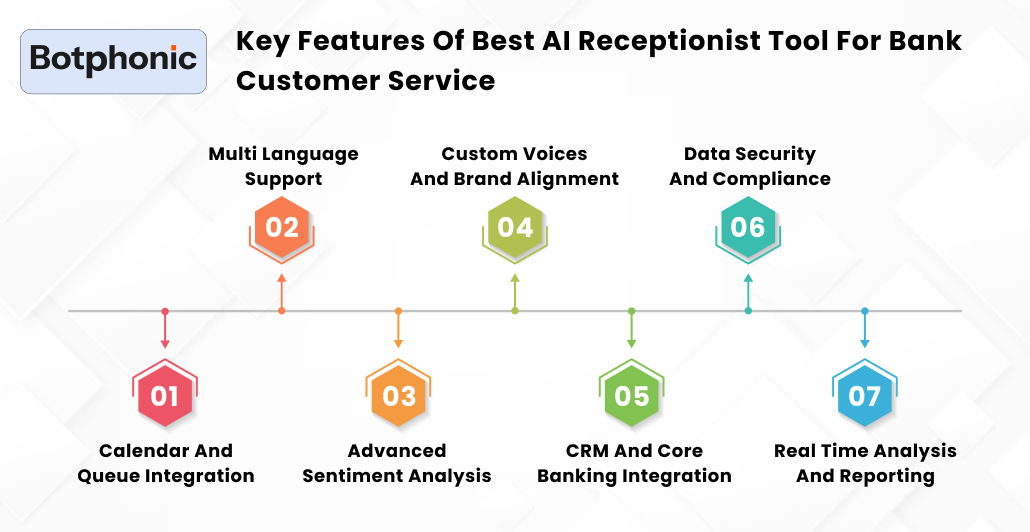

Key features of best AI receptionist tool for bank customer service

When you are looking to choose the best AI receptionist tool for bank customer service, know that it’s not only about automation rather a combination of intelligence, personalization and compliance. Modern day receptionists from Botphonic go way beyond just answering calls; they act as a digital partner of the bank’s team. Some standout features that you must look for are:

- Calendar and queue integration: If your AI call assistant integrates seamlessly with the calendar it can help schedule appointments, look after waitlists and keep sync with existing systems. It can avoid chances of no shows and double bookings.

- Multi language support: Banking service is a sector that happens to deal with people from different backgrounds that speak different languages. Hence AI receptionist’s multilingual support can converse in any language to make them feel included and safe.

- Advanced sentiment analysis: These modern day AI receptionists from Botphonic can sense the tone of the client and adjust replies accordingly. It is able to provide empathetic replies which sound just like humans.

- Custom voices and brand alignment: These days you can customize voice, tone and styles of AI assistant to match your brand identity. You can make it sound as you want to, which is necessary for the finance sector.

- CRM and core banking integration: AI receptionists must have excellent ability to connect with CRM and other existing banking systems. It can help them have access to client data and history allowing them to provide personalized responses.

- Data security and compliance: Rather than those basic tools, AI receptionists are built with encryption and all security controls to make sure financial data and conversations are safe.

Cost benefit of implementing AI receptionist for bank customer service

The financial effect of using AI receptionists in banking customer service goes beyond just reducing salaries of staff. It is estimated that on average the cost of hiring and maintaining a full time receptionist can cost around $30,000to $45,000 per year. On the other hand if you choose even a premium AI receptionist tool it only ranges from $1,000 to $5,000 per month. Isn’t the difference obvious? This difference can help you save a lot of money with long term compelling benefits.

AI receptionists are mainly helpful with round the clock availability without paying them for overtime, spending training expenses and avoiding inconsistencies. With these advanced receptionists you can avoid chances of missed calls reducing chances of slipped revenue. For the banks that are experiencing growth, AI receptionists can have predictable scaling costs rather than recruiting a new team member. These AI solutions can scale immediately and adapt to the needs without increasing overhead costs.

List of best AI receptionist tool for banking customer service

1. Botphonic AI

Botphonic stands out as a premier choice for the most advanced AI receptionist for banks and the financial sector. It has seamless integration capabilities with all CRMs and core banking integration. It supports multiple languages, sentiment analysis and provides features to customize voice. Hence leading to true personalized experience for clients. It even lets agents have real time updates, compliance is on point with a cost effective subscription. Botphonic is a preferred choice for banks that are looking forward to enhancing efficiency and client satisfaction.

Choose best, choose Botphonic AI for your banking customer service.

Get started now2. Nextiva

Nextiva’s plus point is a solid call handling facility and automation features. Although it’s an efficient choice, it lacks personalization, sentiment detection and deep CRM integration.

3. FinAI agent

FinAI is fantastic, however its AI features are quite simple. Even in terms of advanced analytics and multilingual capabilities, it is lacking. It could be a great choice for banks that want to only implement AI to handle basic tasks.

4. Ring Central

Ring Central is known for its VoIP and management of calls. It might be a reliable choice but not when it comes to banking specific customization. It does not excel AI driven customisation which is very much necessary in this modern era.

5. Aircall

Air call is best for call routing and collaboration among tools. But again it lacks advanced features such as sentiment analysis, real time transcription and dynamic conversation. It is a lesser preferred choice for banks that focus on providing personalized customer services.

Conclusion

An AI receptionist for financial advisors has come a long way from being just a futuristic approach to a lively front desk operator that greets each client in the best manner. It is transforming how banks operate by bringing speed, personalization and reliability all together. From handling calls to integrating with CRM and knowing about customer sentiments, these tools are changing how banks engage with their clients.

For the banks that are looking forward to stay competitive using the best AI receptionist tool for bank customer service is the apt strategy. While technology is handling routine tasks, your human agents can focus on more important tasks creating a balance of efficiency and personal touch.