Summarize Content With:

Quick Summary

Remaining high-paced throughout all sectors, change has not left the insurance space behind either. Old methods of managing customer inquiries and providing excellent service must literally pale in front of new sharp bite technologies with the advent of AI phone call solutions which are indeed impressive and game-changing inventions. These have formed a difference in the style of dealing with policy inquiries, claims, and general customer service, whether you be insurance agent or merely policyholder.

This blog discussion would bring to light and eventually be bringing the best AI phone call solutions designed rather for the insurance agency. We will deep dive into the advantages to accept real examples of application and perhaps even on-the-ground guidance that will allow insurance companies to optimize streamlined operability, enhanced productivity, and increased satisfaction of the customers on policies. All of these activities are expected to be done while not compromising the quality of services call centers provide. This guide will help you already understand some important factors to consider while heading out into the world of AI call assistants, whether your integrating AI in your call center or easing the process of policy inquiries.

Introduction

In today’s smart world, insurance agencies are constantly bombarded with demands for more policies, claims, and other customer service requests. This is where an AI phone call assistant swoops in and streamlines operations, enhances productivity, and even effects a better customer experience. You can imagine all the calls an individual can handle at once, while providing constant responses, reducing wait time for customers, and saving invaluable resources.

The adoption of AI into the workflows won’t just be just task automation, but will focus on customer service optimization, consistent delivery, and also freeing up even more time for agents to focus on the more complicated inquiries. General inquiries about coverage, claim status updates, and even overwhelmed agents requesting help on tedious administrative tasks will be addressed. Future customer service uses that capture the imagination of puppet masters might also include everything imaginable.

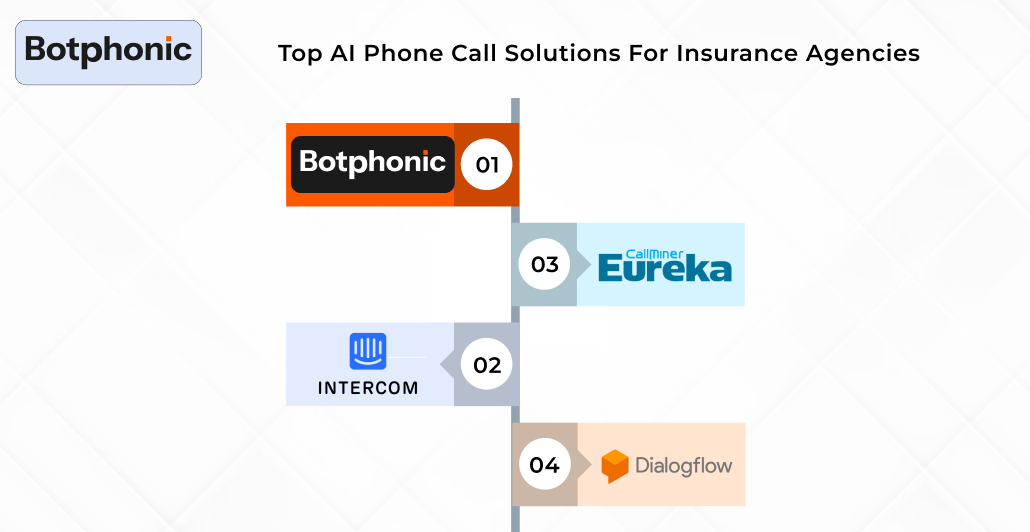

Here we go into the latest. These are some of the best AI phone call solutions available now for insurance agencies.

What Is AI Phone Call Software for Insurance Agencies?

Chatbots on the phone would frame an AI system that performs artificial intelligence to emulate conversations. The sets of solutions should have a few of the main components such as natural language processing and machine learning algorithms, allowing understanding of and enabling the processing of queries from customers and responding to them within a certain time frame. Called by such names as AI-aided call assistant, AI phone assistant, or just a virtual agent, the technology has become commonplace.

Such systems transmit communications via artificial intelligence including simulated conversations between customers and agencies through their phones. Each solution is equipped with machine learning algorithms and NLP allowing it to understand, process, and respond to consumers’ inquiries in real-time. Commonly referred as AI call assistant, AI phone assistant, or virtual agent.

The AI phone call assistant for insurance agencies can perform all these functions for the companies: it can respond to frequently asked questions, handle specific inquiries about policies, streamline workflow with agents, and even assist in claims processing. All these benefits such software provides 24/7 availability with reduced operational costs besides accurate performance and higher satisfaction levels.

Top AI Phone Call Solutions for Insurance Agencies

1. Botphonic AI

Botphonic AI is one of those technology innovations in this field, and it’s highly flexible in AI phone call solutions. Built to meet the requirements of the insurance industry specifically, this platform also provides newfound voice AI capabilities that will solve customer inquiries in real-time, automate routine tasks, and have an overall efficient service provision.

Specifically designed to cater for the needs of the insurance industry, Botphonic AI, stands out as one of the most innovative and highly adaptive AI phone call solutions. This platform also features voice AI capabilities which help agencies answer customer inquiries in real-time, automate routine tasks, and boost their overall service efficiency. The solution, therefore, combines speech recognition with machine learning for smart, context-aware interactions that sound natural and intuitive. It also integrates with CRM systems for a customized touch to customer interactions.

Pros:

- High-quality, natural-sounding voice interactions

- Customizable to match the branding and tone of your insurance agency

- Easy integration with popular CRM platforms and other tools

- Provides both inbound and outbound call capabilities

- Real-time analytics for tracking customer interactions and agent performance

Cons:

- Initial setup may require some technical expertise

2. Intercom

Intercom built its reputation in chat-first environments, but its AI-powered customer communication suite now includes voice and call automation features that insurance teams use for lead qualification, policy FAQs, renewal reminders, and onboarding guidance. Its strength lies in blending human agents with AI in a seamless, branded experience.

Pros:

- Smooth transition between AI and live agents

- Strong automation tools for sales and support

- Excellent UI and team collaboration features

Cons:

- Voice tools aren’t as specialized as dedicated call AI platforms

- Pricing can rise quickly with scaling

3. CallMiner Eureka

CallMiner can be counted as one of many popular AI-powered assistants, it offers an AI-driven solution that helps insurance agencies automate customer interaction. Moreover, it also allows customers to get answers, such as common policy-related questions, claim status updates, and more, all while integrating seamlessly with CRM systems.CallMiner is well-known for natural sounding conversational ability.

Pros:

- Deep analytics for improving agent performance

- Detailed insights into customer behavior

- Scalable for both small and large agencies

Cons:

- Requires data-driven approach for optimal results

- Some learning curve for setup

4. Google Dialogflow

Google’s Dialogflow is an incredibly powerful tool for creating AI-powered conversational interfaces, including phone call assistants. Many insurance agencies leverage Dialogflow to develop their own voice assistants for automating customer interactions. With the integration of Google Cloud, it’s highly scalable and customizable.

Pros:

- Flexible and customizable solution

- Integration with multiple third-party platforms

- Powerful NLP capabilities

Cons:

- Can require significant development resources

- May need third-party services for full integration

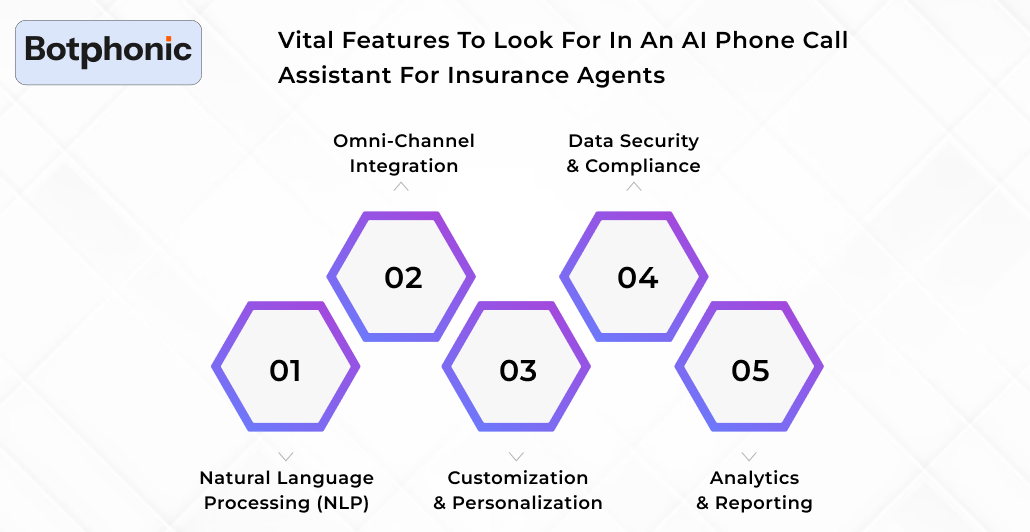

Vital Features to Look for in an AI Phone Call Assistant for Insurance Agents

Essential Characteristics to Seek in an AI Phone Call Helper for Insurance Brokers

The selection of an AI phone call solution for your insurance company is a very important task and it is crucial to check if the software meets your special requirements. The following are a few of the best features that could either be a deciding factor or a break for your AI phone system.

1. Natural Language Processing (NLP)

NLP is the core technology of any efficient AI phone call solution. It allows the software to comprehend the customer’s queries and to reply correctly. NLP that is not very good may lead the assistant to misinterpret the customer’s requests and thus result in customer dissatisfaction.

2. Omni-channel Integration

A phone assistant powered by AI should not be restricted to just handling calls. The majority of the best solutions integrate across various channels like emails, chats, and social media allowing a single experience for your customers no matter how they contact.

3. Customization & Personalization

Every insurance policy is different and customer needs are also different. A great AI phone calls improve policyholder experience, as it can be customized according to your company’s specific products, thus making the responses more personal and relevant.

4. Data Security & Compliance

Insurance is a very regulated industry and, thus, the security and privacy of customer data are of utmost importance. The AI phone system must follow the compliance regulations which can be strict depending on your region, for example, GDPR or HIPAA.

5. Analytics & Reporting

Customer interaction insights are priceless. AI solutions should provide powerful analytics that aid in the detection of customer pain points, call metrics tracking, and optimization of the whole operation for enhanced performance.

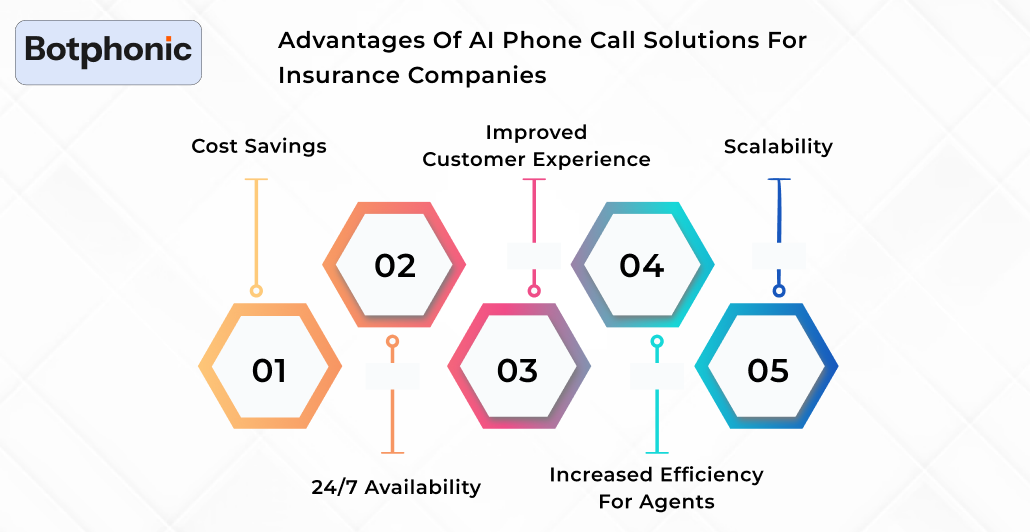

Advantages of AI Phone Call Solutions for Insurance Companies

The advantages associated with the integration of AI phone call assistants into the insurance sector are numerous; however, the following few advantages are powerful enough to change the fate of your insurance business completely:

1. Cost Savings

Automating routine tasks like addressing FAQs or performing checks on the claim status can bring down the need for extra human agents to a great extent which in turn will help your agency to save both time and money. As per research, it was seen that about 60% of insurers are using AI for fraud detection, that’s leading to about a 30% reduction in false claims.

2. 24/7 Availability

AI assistants do not sleep, they provide customer service every hour of the day, every day. This is a benefit that particularly applies to the insurance sector as the customer questions can come in at any time.

3. Improved Customer Experience

Your clients will be receiving a more and more integrated and efficient service due to faster replies, consistent communication, and reduced waiting times resulting in increased satisfaction and loyalty.

4. Increased Efficiency for Agents

AI phone call assistants take over the monotonous works allowing the agents’ full attention on the difficulties of the customer. This not only leads to higher productivity and job pleasure but also assures that the staff are dealing with the most important tasks.

5. Scalability

The solutions powered by AI are naturally scalable. The tools will be able to handle calls, inquiries, and data without the need for a corresponding increase in the staff as your agency expands.

The Future of AI Phone Call Technology in Insurance

The insurance sector is going to witness a bright future of AI. We can expect even more advanced voice assistants that will not only manage basic queries but also predict customer needs. Providing personalized policy suggestions, and even forecast the trends in insurance claims as AI technology keeps on advancing.

The insurance industry players who adopt AI-based phone call solutions today will be future-ready. The trick to leveraging AI phone call system technology efficiently is to pick the right solution. Proceed by tailoring it to your specifications, and so on.

Explore Ai-Powered Phone Call Solutions Today And See The Difference For Yourself.

Try Botphonic Now!!Conclusion

AI phone call solutions have become new present for every industry. Working towards welfare it’s making a tangible difference in the insurance industry. Whether you just want to enhance your customer service, reduce operational costs, or improve your team’s efficiency significantly. AI call assistant offer a practical solution that delivers real results.

As insurance agencies have to started to embrace this technology, they are looking at more efficient future. You should start exploring the options, evaluate your company’s needs, and choose the AI solution that aligns with your business.