Summarize Content With:

Summary

AI receptionists have become a powerful solution for insurers. These intelligent and conversational bots are available 24/7—they execute client intake, handle queries, provide status updates to policyholders, and collect documents without taking help from human agents. AI agents streamline the process of insurance companies, follow compliance standard and improve the customer satisfaction level.

In this journey, the AI receptionist has become an essential tool for operational agility and providing superior services. With an AI receptionist, calls get captured instantly, and every client gets engaged and downtime becomes almost zero. Imagine the possibilities for growth of your business if all of your clients received attention. Want more details? Read this blog; here I will discuss how ai receptionist for insurance claim handling can become your growth partner. Let’s begin!!!!!

Introduction

In the insurance industry, customer trust and satisfaction are directly linked to timely communication, clear claim updates and reliable services. Claiming insurance is a touchpoint that can make or break the insurance company’s reputation. Traditionally, insurance claims companies are more dependent on calls and manual handling of operations. This makes the workflows inefficient. Reason? High call volume scenarios, long wait and continuous increases of operation costs. Claim process is a stressful and critical interaction for the policyholder.

Long hold times, inconsistent responses, limited office hours, and the need for fast, accurate updates make the process frustrating for both customers and insurers. Last month, my insurance agency faced a major challenge. Multiple clients were calling simultaneously and my team was incapable of handling such high-volume call scenarios. We have missed out on a few important claims, as we were unable to provide responses to customers on time.

What if you lost your customers due to a minor delay after establishing so much trust? Sounds frustrating!!! But the good news is that AI -powered receptionist has changed the entire game. After applying to be an AI receptionist in my insurance agency, I discovered incredible changes. Now, we are able to handle a high volume of calls and process claims quickly. Clients no longer have to wait a long time to finalize the procedure. And most importantly, AI receptionists provide instant and reliable responses and free agents from repetitive tasks, so now they can focus on complex work that requires high attention. With AI receptionist software, you can reduce costs and every policyholder will get consistent, efficient and empathetic support.

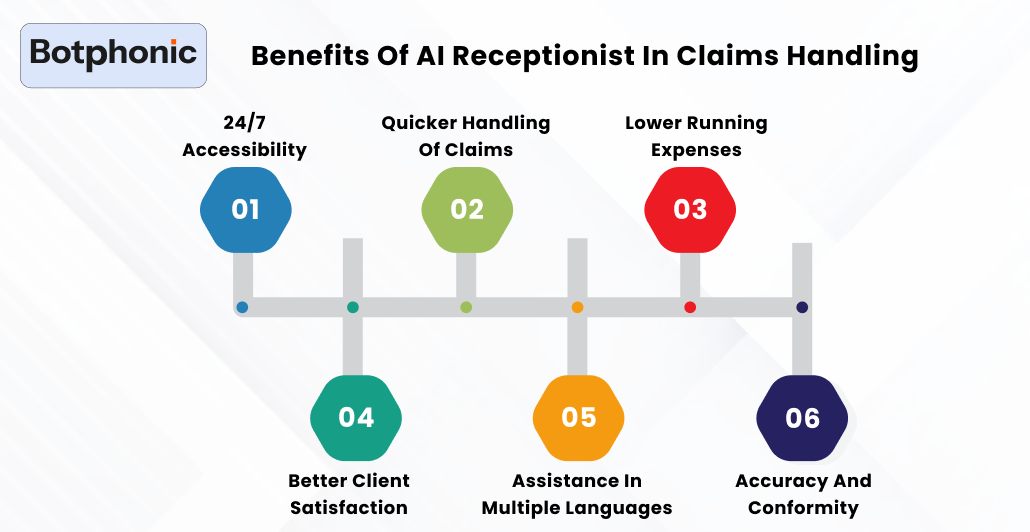

Benefits of AI Receptionist in Claims Handling

Let’s check out:

1. 24/7 Accessibility

In the traditional system, the claim process was possible only during business hours. And the customer needs to wait long to accomplish the work. With an AI receptionist, a policyholder can raise queries related to claims even after business hours. Whether it’s day or midnight, AI agents are active around the clock and instantly resolve queries and provide updates of claims reports.

2. Quicker Handling of Claims

In the traditional system, one of the biggest stress agents faced is regular follow-ups with clients. This was a time-consuming and laborious process. At the end, agents become exhausted and the insurance business doesn’t get the expected results in spite of striving hard. Previously, my team took a few weeks to verify the leads. Most of the time, my team spends on low-quality prospects. But with AI receptionists, we no longer take hassles of qualifying claims. The AI voice assistant instantly collects details from the customers and verifies them during the live calls. Everything goes more quickly overall, and my team can now handle the claims with greater accuracy and speed without any delays.

3. Lower Running Expenses

Formerly, insurance agencies needed to expand the team to deal with high call volume scenarios. But with the AI receptionist software, you no longer need to spend budget on extending collaborators. Ai receptionist are adept at handling a large volume of calls. Whether you get 100 or 10000 calls per day, AI agents are capable of managing calls with proper responses and without delays. Now, human agents can focus on complex and high-touch cases that require more focused attention.

4. Better Client Satisfaction

When agents handled claims in the conventional system, customers felt that we weren’t giving their concerns enough attention, and my team frequently gave them delayed answers. This is the major reason we lose customer trust and weaken the overall experience. Are you also having trouble responding to customers promptly? But with an AI receptionist, you can easily bridge this gap.

An AI receptionist provides empathetic, immediate and consistent resolutions to policyholders. After applying the AI receptionist, my customers now feel we are taking them seriously and prioritizing all their concerns. Result? Customers feel more comfortable using our services, satisfaction level becomes high and naturally their loyalty and net promoter score improve.

5. Assistance in Multiple Languages

Insurance claims industry serves a diverse audience. In the traditional phone system, customers felt annoyed due to language limitations, as agents were incapable of providing them responses in their preferred languages.

But the AI receptionist has easily resolved all the language limitations that insurance agencies were facing. AI agents will only provide feedback in Spanish if your customer speaks the spanish language. With the AI call assistant, every customer will get a smooth and natural experience in the language of their choice. Result? With AI agents, businesses are capable of building stronger connectivity and better trust.

6. Accuracy and Conformity

In the insurance industry, security and compliance are non-negotiable aspects. In traditional call centers, manual errors and delays in identity verification are frequently observed and are more prone to risks. With AI receptionist software, identity verification becomes faster and more secure.

Plus, the AI receptionist system fully adheres to HIPAA, GDPR, and state-level insurance rules. Overall, with a receptionist platform, the workflow becomes fast, 100% secure and completely dependent on rules and regulations.

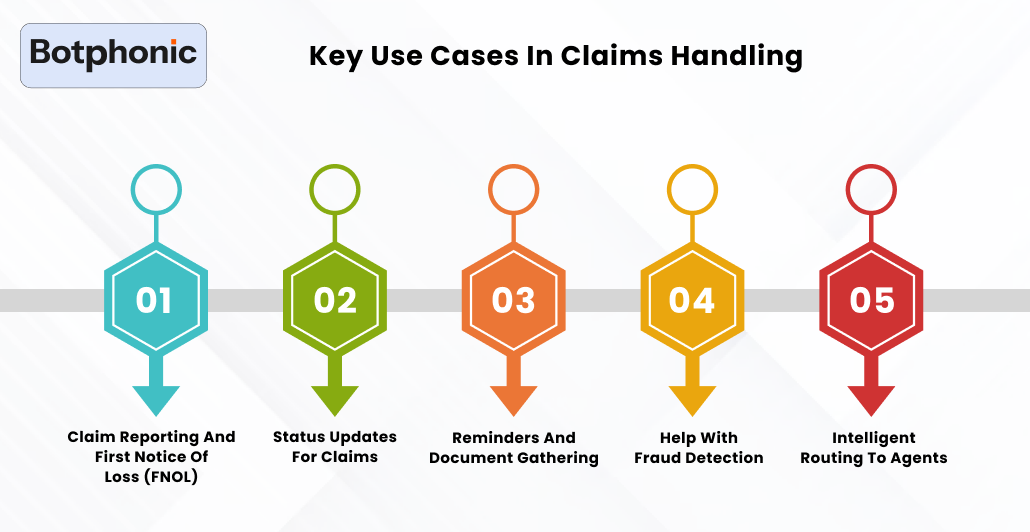

Key Use Cases in Claims Handling

Let’s find out:

1. Claim Reporting and First Notice of Loss (FNOL)

It is the first action taken when a customer reports an accident or incident. In a traditional phone system, this process was slow and confusing, but now an AI receptionist provides a step-by-step guide:

- Collects policy number and verification details.

- Ask structured questions related to incidents.

- Directly updates the claim in the claim management system.

Overall, with an AI receptionist, you can minimize the delays and gather accurate information.

2. Status Updates for Claims

In a traditional phone system, a customer had to wait on hold to get claim-related updates. Now, with AI regulation platforms in insurance sectors, the entire process becomes simple and extremely easy; customers just need to ask questions like, “What’s my claim status?” and “Has my payment been processed?” Further, AI receptionist agents immediately capture the real-time updates from the insurance system and provide immediate solutions to the customers.

3. Reminders and Document Gathering

As we know, the claims process requires a huge amount of documents, such as photos, medical reports, and repair estimates. This process takes significant time and is vulnerable to errors. With an AI receptionist, you can easily execute the document-gathering process.

The AI receptionist sends reminders and shares upload links with customers and also provides them with receipt confirmation. Overall, AI agents make the entire process hassle-free.

4. Help with Fraud Detection

Fraudulent claims are one of the biggest challenges of the insurance industry. An AI receptionist can automatically detect suspicious patterns, such as inconsistent event descriptions and flag them for further investigation.

5. Intelligent Routing to Agents

Every claim is not simple. Few critical cases like litigation and disputes, still demand human expertise. In this scenario, the AI receptionist smartly escalates the case to the right department and shares the complete background of customer profiles with agents to rectify the issue right away.

Why Does Claims Handling Need an AI Receptionist?

Let’s check out:

- Call Overflow: Insurance companies get thousands of calls per day. It is practically impossible for human agents to handle such a high volume of calls. With an AI receptionist, you can easily manage high-volume call scenarios; you don’t need to set up extra members to handle such stressful situations.

- Long Hold Times: keeping customers on long hold sounds frustrating. This creates negative impacts on loyalty and trust. With ai receptionist, you no longer have to put calls on hold. AI accesses all the customer details and provides them prompt solutions without any delay.

- Inconsistent Experience: Every agent’s call quality is not the same. Each agent has a different approach. With AI Receptionist, customer experiences remain consistent and flawless throughout the journey.

- High Operational Cost: Maintaining large call centers, hiring staff and providing them training is an expensive approach. Plus, human staff members will not be available after business hours. AI agents are less expensive than human agents and provide 24/7 assistance to customers and updates in the same CRM as well, eliminating the stress of manual entries.

- Limited Availability: Human staff covers only business hours. If your customer raises concerns after office hours, then they need to wait till the next day to get the resolution. Eventually, you will lose customer trust, as long wait times will annoy them. With ai receptionist ,you can serve your customers 24/7 with more accuracy. This will help you establish deep connections and stand out in the vibrant marketplace.

Overall, AI receptionists eliminate the inefficiencies and deliver always-on, consistent, and cost-efficient claim support. Further, with ai agents policyholders get instant help and the entire process becomes smooth and 100% flawless.

From claim reporting to fraud detection—let Botphonic AI Receptionist be your growth partner. Book a Demo.

Request a Free DemoConclusion

AI receptionists are becoming indispensable for modern insurance companies. By automating claim intake, status updates, and routine queries, they significantly reduce processing times, improve accessibility, and enhance customer satisfaction. At the same time, they allow businesses to scale efficiently while ensuring legality and security.I hope that the blog post above has given you some helpful information about how the best AI receptionist software streamlines the insurance claim processing procedure to provide quicker, more intelligent, and more compassionate claims experiences.

Still having doubts? Connect with Botphonic!!!!