Summarize Content With:

Summary

This blog is packed with information about the AI phone call assistant for insurance agents, why it is indispensable to insurance agencies, how the Botphonic solution works, its advantages, competitor analysis, practical use cases, problems, and tips for getting started. In addition, we supply practical advice and firsthand experience to help insurance agencies make the right decision regarding this technology.

Key Takeaways

- The high volume of phone calls can be handled by an AI phone call assistant for insurance agents. Furthermore, such a system can also qualify leads and even initiate routine client interactions. Human agents will thereby be liberated from such mundane tasks and can concentrate on more complex ones.

- Botphonic provides a safe, standard-supporting, and easily upgradable AI voice assistant with some eminent features, such as compliance (HIPAA, GLBA), a contact centre without time limits, and conversation analytics.

- In terms of competition, Botphonic is the leader in the field of realism, security, and balanced integration capabilities.

- While using an AI call assistant, agencies should organise script creation, compliance, training, and continuous evaluation to ensure a positive return on investment.

Introduction

Imagine this: your insurance agency is flooded with phone requests for quotes, renewals, claims, and follow-ups; however, your human team is overworked. Some calling lines remain silent due to the lack of response. Potential clients disengage. Your agents become exhausted through overwork. But now think of an assistant who never sleeps, never runs out of energy, never forgets, and talks just like a real human. This is the AI phone call assistant for insurance agents.

At Botphonic, we have developed an AI voice assistant that can handle your calls, qualify leads, assist your clients, and give your team back the time you spend. In this blog, I will explain to you how this works, why it is important, and how your agency can benefit from it.

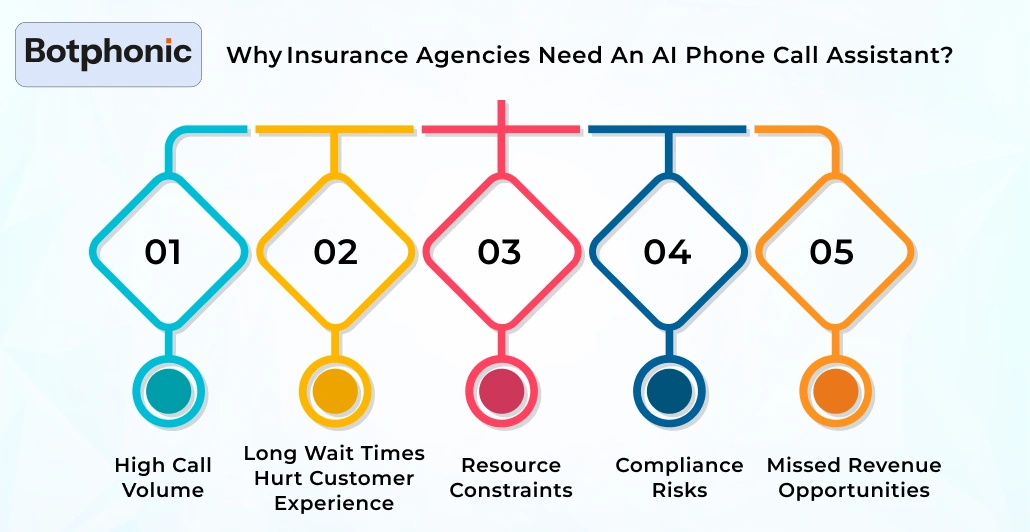

Why Insurance Agencies Need an AI Phone Call Assistant?

Insurance is a business heavily dependent on human interaction. The problem is that the situations that agents are required to respond to include inquiries about the policy, renewals, claims, lead calls, cross-selling, and upselling, and, at the same time, they must maintain constant service. The amount of work involved in these tasks can be too much even for the most efficient team.

AI call assistant helps to lessen this kind of work substantially and also contributes to the smooth running of the business.

1. High Call Volume

The daily call influx is a challenge many insurance agencies face. These calls range from easy questions (“When is my premium due?”) to complex ones (“Can I change my beneficiary?”). Human agents spend a lot of time answering repetitive, low-value calls. If an AI phone call assistant for insurance agents is installed, the system can handle most routine requests without involving your team.

2. Long Wait Times Hurt Customer Experience

Customers who make a call and have to wait for a long time become less satisfied. This, in turn, affects retention. There is always an AI assistant waiting to take calls immediately, in the shortest time possible; hence, it can work around the clock and reduce waiting time, so customers will always be attended to within their requested time frame.

3. Resource Constraints

More agents cannot be hired at a reasonable price. Even after they have been trained, more time will be needed to fully prepare them. With an AI assistant, scalability becomes possible because once it is set up, it can handle multiple phone calls without breaks or holidays.

4. Compliance Risks

Insurance is one of the most regulated business areas. A possible mistake in how the client’s data is handled during a call can result in a significant financial loss. A state-of-the-art AI phone call assistant for insurance agents, such as Botphonic, is well-equipped with features that ensure compliance.

5. Missed Revenue Opportunities

Insurance is competitive. Hence, leads are very important. Quite a few potential customers make their first contact at odd hours or get lost because an agent couldn’t follow up immediately. An AI assistant can handle lead qualification, reminders, and callbacks, so there is no letting go of a single prospect.

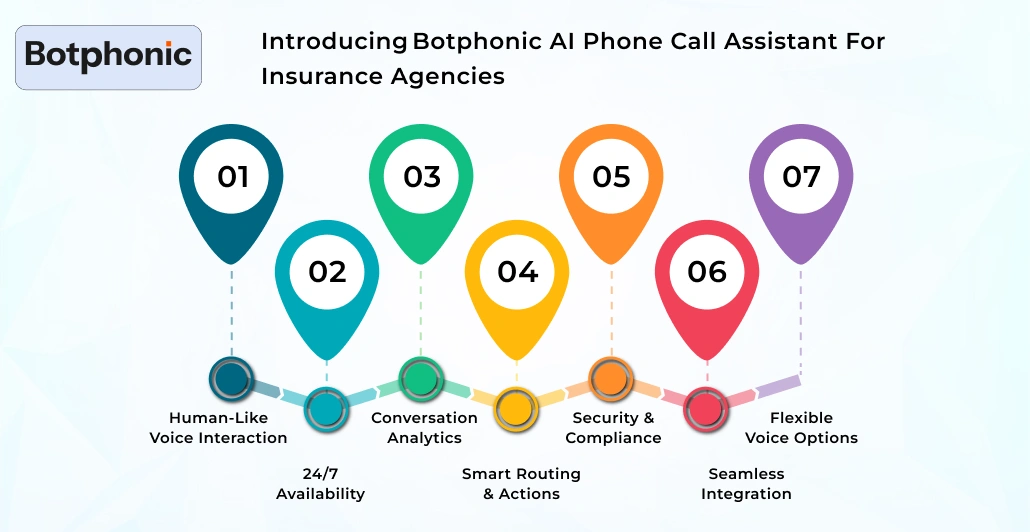

Introducing Botphonic’s AI Phone Call Assistant for Insurance Agencies

Exactly in what way can Botphonic be of assistance here? The solution is an AI phone call assistant for insurance agencies, which, by itself, performs the communications that are normally routine, positively influences the agency’s output, and makes sure that the customers continue to be treated in the best possible way.

What Botphonic Offers:

1. Human-Like Voice Interaction

The assistant of Botphonic is equipped with speech that resembles normal human interaction. It is absolutely not robotic – rather, the majority of the time, people on the other end of the line are not even aware that they are talking to AI.

2. 24/7 Availability

This helper is still functional even when it is time for rest. Clients are allowed to call at any hour of the day or night, even if your human crew is out of service. In this way, you are always guaranteed to have new leads.

3. Conversation Analytics

With the help of technology, Botphonic is a unit capable of being a real-time transcriber of conversations and, at the same time, generating a host of analytics for each call it handles. To accomplish this, the system captures the main ideas, evaluates emotions, and provides summaries. All these are done in real time, and you can therefore make plans based on the data extracted from these interactions.

4. Smart Routing & Actions

Once your conversation starts, the AI understands your needs, connects you with a human assistant if needed, and carries out previously set requests (like booking, data gathering, or sending an email). Botphonic lets you create the flow, choose the call steps, and integrate with your CRM or other systems.

5. Security & Compliance

Botphonic has been designed with safety and compliance as its top priorities. It can comply with HIPAA, GLBA, and other regulations applicable to the insurance sector.

In addition, it employs end-to-end encryption, multi-factor authentication, and logs ready for inspection.

6. Seamless Integration

The service can be combined with more than 180 different instruments through either API or SIP. This essentially means your smart AI assistant can connect to your CRM, policy management system, and other workflows.

7. Flexible Voice Options

There are 65+ voices that you will eventually be able to select from. A voice that best suits your brand is one you would want to use: approachable, business-like, quiet, and expert.

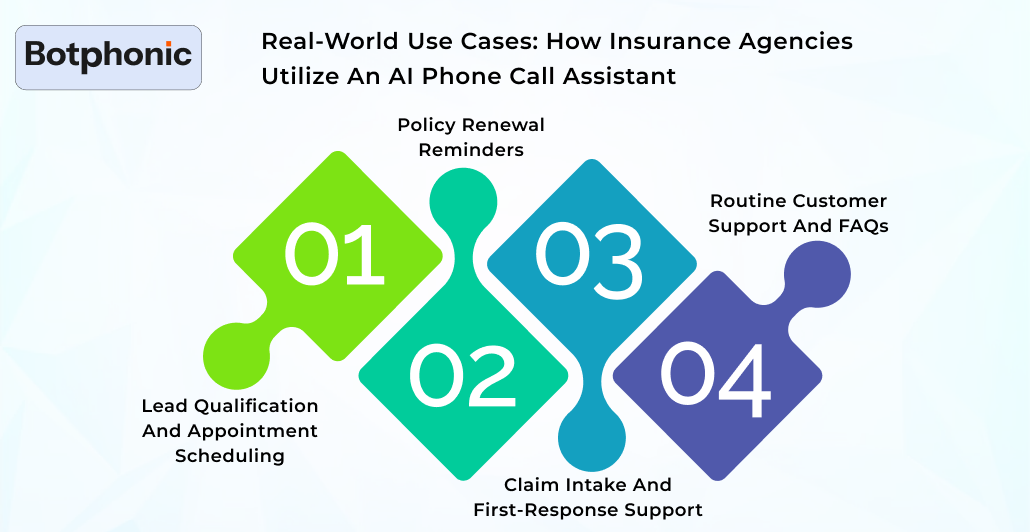

Real-World Use Cases: How Insurance Agencies Utilise an AI Phone Call Assistant

1. Lead Qualification and Appointment Scheduling

Insurance agencies use an AI phone call assistant to call leads promptly and qualify them by asking intelligent questions. Based on the answers, the assistant understands coverage, budget, and timelines.

If a prospect agrees to the meeting, the assistant schedules the appointment and notifies the human agent. Time is saved, and conversion rates are higher. Also, this method guarantees that no lead will be lost due to waiting time.

2. Policy Renewal Reminders

With the help of an AI assistant, a customer is never forgetful about their insurance policy that is about to expire, thanks to consistent, customer-friendly notifications. Additionally, it discusses renewal dates, payment, and benefits. If the customer needs any assistance, he is given directions to the next step or the contact details of a human agent. According to Gartner, by 2026, conversational AI deployments are expected to reduce contact center agent labor costs by US$ 80 billion .

The number of policy recurrences decreases while customer satisfaction increases. Besides that, agencies become better at customer relationship marketing over time.

3. Claim Intake and First-Response Support

Initial claim calls are delegated to the AI assistant employed by insurance agencies. In detail, the assistant obtains the claim information, confirms the identity, and documents the incident description.

Beforehand, it helps customers understand which documents are required and facilitates appointments for the claim review. A process like this accelerates the use of a claim and lessens the burden on agents. Also, customer confidence is enhanced as their immediate help arrives.

4. Routine Customer Support and FAQs

The AI assistant assists customers by answering their questions about premiums, policy terms, payment dates, and coverage details. The assistant solves simple problems within seconds, while complicated issues are referred to human employees. By this means, the system that supports customer needs results in a faster call response rate, thereby shortening or even eliminating waiting time.

Moreover, customers receive proper information, their satisfaction being at a maximum level, while help teams experience less pressure. Besides that, the system guarantees that answers are returned every time and they are both accurate and reliable.

Why Botphonic Is the Right Choice?

In brief, Botphonic would be the best pick of an AI phone call assistant for insurance agents. This technology integrates a lifelike voice with a natural conversational flow and provides actionable call analytics.

- Summarizing the reasons why Botphonic would be the best option for an AI phone call assistant for insurance agents:

- Among other things, it combines real voice, deep conversational flows, and actionable call analytics.

- Most importantly, the product complies with regulations, which is very necessary in the insurance business.

- Not only that, but it also has strong integration capabilities, allowing compatibility with your current systems.

In addition, the product is scalable and available around the clock, so there is no missed call.

Botphonic’s AI assistant is the right tool for the job of handling routine calls, which can be a great freeing of your human agents to focus on big-ticket policies. So you will see the conversion rates going up and the call center costs going down.

Try it Today!Conclusion

To sum up, AI phone call for insurance policy inquiries are turning into a must-have instrument for the agencies of the future. At the very least, a device like Botphonic’s AI phone call assistant for insurance agents can revolutionise the way an insurance agency works. Through this, your agency can be more efficient in communication with clients, save money, make customers happier, and provide your agents with the opportunity to engage in more valuable tasks.

Given that timely communication, trust and compliance are the core of the industry, the assistant is both safe and scalable. To fully harness its potential, however, the device should be implemented with caution, using well-thought-out scripts, conducting pilot tests, and maintaining continuous monitoring and compliance checks. The future of insurance is not only digital, but it’s also conversational, data-driven, and always available.