Summarize Content With:

Summary

By providing AI call automation in U.S. financial services, you can automate calls and strengthen customer interaction while saving time, as well as being compliant. Solutions like Botphonic AI can increase satisfaction, efficiency, and ROI while serving as an instrumental tool for banking/fintech support in today’s day and age.

Introduction

Imagine ringing your bank to communicate some urgent need, only to hear for the next quarter of an hour: “Your call is important to us.” The majority of consumers are frustrated even before an agent has the opportunity to utter a word. In the U.S. financial services industry, customer experience tends to shatter at the first touchpoint: a phone call.

With expectations at an all-time high and patience at an all-time low, banks, lenders, and fintech companies now seek faster, smarter methods of serving customers that comply with but don’t break the rules. This is the difference AI Call Automation Financial Services USA solutions actually make in this process.

Today’s consumers demand instant answers, transparent communication, and secure treatment of their data. They anticipate this at any time, on any day. Large-scale responsiveness. Traditional call centers are not able to provide this type of responsiveness at scale. Machine-learning voice systems now step in to help teams, lower friction, and renew trust. Solutions like Botphonic are enabling U.S. banks to provide compliant, consistent, and lifelike voice interactions without adding operational burden.

U.S. consumer banking satisfaction remains high despite the growth of digital channels, according to the J.D. Power 2017 U.S. Retail Banking Satisfaction Study

The State of Customer Experience in U.S. Financial Services

Customers don’t appreciate having to wait on hold for a long period just so they can find out how much is left in an account, make a payment, or straighten out any issues with cards. Stumbling blocks in the form of fraud verification lead to access to accounts being delayed, causing stress in what can be a stressful time. High compliance costs compound the issue, requiring firms to spend large amounts of money on training, monitoring, and legal protections.

American consumers spend an average of 13 minutes on hold each time they call their bank, according to J.D. Power’s estimates, a barrier that reduces satisfaction and trust. These are the kinds of delays that can occur before anyone has even begun to provide real help.

AI Call Automation Financial Services USA solutions aim to mitigate these issues by processing both simple and sensitive calls with smart voice systems. This shift mirrors how AI for financial & professional services (USA) is modernizing customer outreach while keeping regulatory guardrails intact.These systems verify customers, send transaction updates, and respond to commonly asked questions, all while staying in line with U.S. compliance standards. AI voice tools don’t substitute human agents; rather, the AI helps them by weeding out the most repeated callers and escalating only high-touch cases.

AI Call Automation Financial Services USA solutions aim to mitigate these issues by processing both simple and sensitive calls with smart voice systems. These systems verify customers, send transaction updates, and respond to commonly asked questions, all while staying in line with U.S. compliance standards. AI voice tools don’t substitute human agents; rather, the AI helps them by weeding out the most repeated callers and escalating only high-touch cases.

This is exactly why AI receptionist solutions for U.S. businesses are becoming the standard for high-volume, compliance-sensitive industries like banking, insurance, and fintech.

Key Pain Points in Financial Customer Support

U.S. banks have ongoing support challenges that impact customers and internal teams. Those issues mushroom as customer bases grow and regulations increase.

| Challenge | Impact on U.S. Firms |

| High Call Volume | Increased staffing costs and agent fatigue |

| Compliance Risk | Hefty penalties for TCPA and FDCPA violations |

| Delayed Verification | Lost trust and higher customer churn |

| Limited Availability | No 24/7 customer engagement |

1. High Call Volume

Financial companies get thousands of calls a day for balance checks, payment confirmations, loan updates, and password resets. The majority of this repetitive work is done manually by human agents, leading to higher personnel costs and burnout. AI Call Automation Financial Services USA performs these types of near-API calls with ease, freeing up time for teams to invest in high-value dialog.

2. Compliance Risk

Stringent laws such as TCPA and FDCPA have strict intentions for handling customer interaction. Handling calls manually exposes you to the risk of script errors, missed disclosures, or out-of-bounds contact. Robotic voice programs adhere to set compliance policies, lessening the risk of fines and monitoring.

3. Delayed Verification

Sluggish identity checks are an annoyance to customers and pose security risks. And if the verification process takes too long, customers are likely to lose confidence and forsake the interaction. AI voice systems rely on well-organized verification flows to quickly and securely validate identity over the phone.

4. Limited Availability

Most call centers have hours of operation, but financial issues can occur around the clock. Patrons who can’t get help after bedtime, she said, “feel left out.” AI-driven voice solutions ensure that engagements are available 24/7, so your customers never have to wait when they need help.

How Botphonic AI Enhances Financial Customer Experience

Step 1: Greeting Customers Securely: The Botphonic AI voice assistant answers the phone with a professional and secure customer greeting. The system makes the call opening sound like people, but testing asks to confirm intent.

Step 2: Identity Verification: Botphonic allows you to verify identities using DOB, OTP, or account PIN. This is a precaution taken to mitigate the risk of fraud and in accordance with U.S. financial regulations. Automated verification eliminates the extended wait times associated with traditional manual call centers.

Step 3: Providing Account Updates: Once confirmed, Botphonic sends you your account status, due date, and loan information in real time. No one likes waiting for an agent to provide precise answers to customers.

Step 4: Logging Interactions: Every interaction is automatically logged into the firm’s CRM or core banking system. This will enable smooth and personalized future customer support.

Step 5: Getting escalated to Human Agents: When a question gets too complicated or too personal, Botphonic passes the call on to a live person. Humans have offloaded the boring, robotic work to computers so that they can be busy having meaningful conversations.

Compliance at the Core (TCPA, FDCPA, GLBA, and OCC)

There is no room for non-compliance in U.S. financial services. Botphonic AI is built to obey the key regulations:

- TCPA (Telephone Consumer Protection Act): Make sure you have consumer consent for all telemarketing and automatic calls. (FCC TCPA Rules)

- FDCPA (Fair Debt Collection Practices Act): Governs collection calls, which keep you from being harassed and also keep them transparent. (Consumer Financial Protection Bureau)

- GLBA (Gramm-Leach-Bliley Act): Preserves customer data privacy and defines the security of communication lines.

- OCC (Office of the Comptroller of the Currency) Oversight: Supervises financial correspondence for compliance with federal guidelines.

Top Use Cases for Financial AI Call Automation

Financial institutions can use AI call automation in several scenarios. Here are the top use cases:

| Use Case | Description | Example |

| Loan Reminders | Automated notifications for upcoming payments | Credit unions & auto loans |

| Fraud Alerts | Immediate verification calls for suspicious activity | Banks & card issuers |

| New Account Verification | KYC & onboarding calls | Fintech startups |

| Outbound Support | Account renewal, upselling, or service updates | Insurance & investment advisors |

AI call automation shortens wait times and returns similar messaging, as well as the proactive calling that leads to increased retention and loyalty.

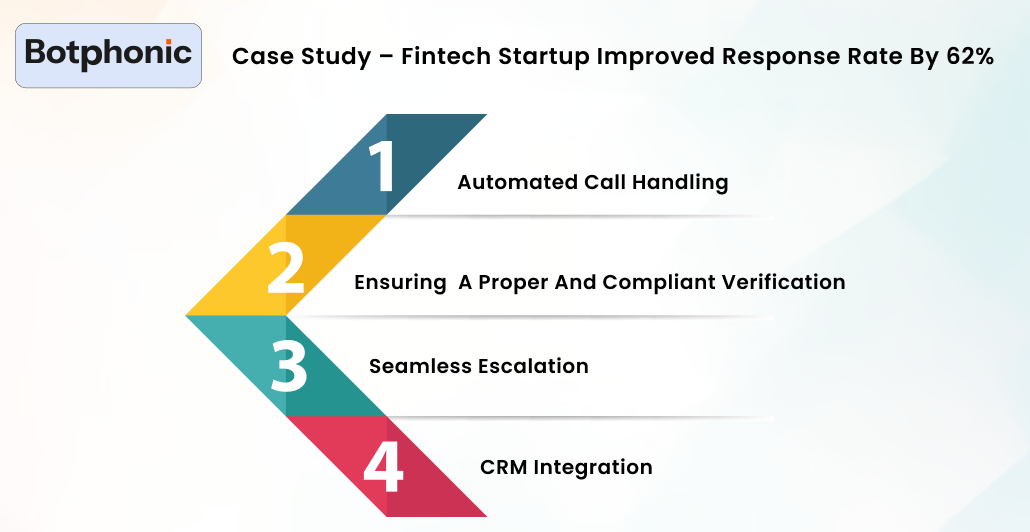

Case Study – Fintech Startup Improved Response Rate by 62%

A fintech startup in New York City wasn’t optimizing support efficiency. The team managed over 12,000 support calls per month and faced numerous challenges:

- Inequitable treatment: Human call processing led some people to get incomplete or later answers.

- High cost of operation: Employing sufficient agents to handle peak times led to costs beyond what the start-up could manage.

For AI Call Automation Financial Services USA solutions, the company looked towards Botphonic AI.

Learn how AI call automation delivers actual ROI, 24/7 access, and compliant customer interactions for U.S. finance.

Try it Today!Step 1: Automated Call Handling

Botphonic AI tackled the mundane calls, such as:

- Balance inquiries

- Payment reminders

- Loan and account status updates

- Fraud verification alerts

With the repetitive work of both being automated, human agents were available to attend to the complex cases and financially sensitive interactions.

Step 2: Ensuring a Proper and Compliant Verification

Botphonic checked users against their DOB, OTP, or account PIN to grant confirmation of identity without slowing down the call. All contacts were in compliance with TCPA, FDCPA, and GLBA requirements, which reduced the costs associated with legal claims related to regulations.

Step 3: Seamless Escalation

When a call demanded human intervention, the AI was able to skillfully pass customers over to live agents with detailed notes and customer history so that they could successfully complete the call without ever repeating questions.

Step 4: CRM Integration

Everything was automatically synced with the startup’s CRM and literally gave the customer support team a bird’s-eye view of anyone they followed up with. This led to enhanced follow-ups, personalized engagement, and monitoring of customer satisfaction metrics.

The Results

The startup saw remarkable improvements after using Botphonic AI:

- Wait Time: We shortened the wait time from 10 minutes to 45 seconds.

- Satisfaction: Customer satisfaction rate increased from 76% to 91%.

- Response Rate: Their overall response rate also increased to 62%, where more calls were connected and concluded successfully.

- Levels of staffing went down: as the firm was able to avoid expensive personnel charges without reducing its relationship with customers.

- ROI: ROI is delivered in the blink of an eye, with a 280% return in only four months, proving how automation isn’t just better for service; it has a real financial impact.

Why This Works

- Great for high-volume, low-complexity calls. There are things that AI does really well, and what it’s perfect for is handling high-volume, low-complexity (HVLC) calls.

- We focus for our human agents on high-value conversations that increase the customer experience.

- Automation ensures that you respond consistently, in compliance with regulations where necessary, and within the required timelines building trust and loyalty.

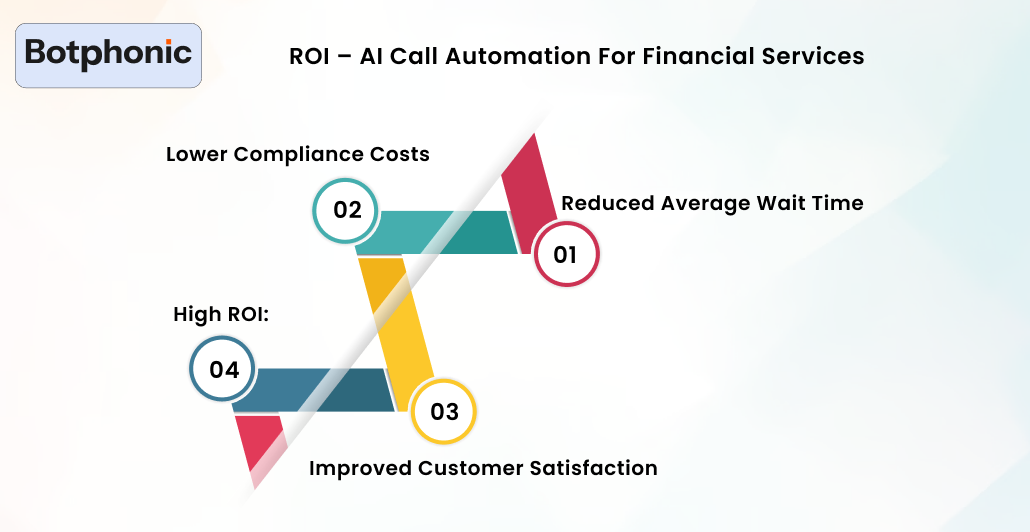

ROI – AI Call Automation for Financial Services

1. Reduced Average Wait Time

Prior to using Botphonic, customers on average spent 13 minutes on hold waiting for an agent, which resulted in dissatisfaction and lost calls. This falls to only 45 seconds with AI Call Automation Financial Services USA, providing customers with rapid responses and improving the efficiency of all calls.

2. Lower Compliance Costs

Manual call management and compliance checks were expensive to staff, costing roughly $10,000 a month. Botphonic offers automated compliance, error reduction, and audit risk mitigation for as little as $4,000/month.

3. Improved Customer Satisfaction

Slow replies and spotty help frustrated customers. We continue our long S-curve adoption of automated, secure, and precise voice interactions, where SAT scores went from 76% to 91%, analogs for a smoother customer experience and deep trust.

4. High ROI:

In ramping up service quality, cutting down costs, and reducing wait times for their own customers, financial services companies recorded an outstanding +280% ROI in just a few months – evidence that call automation with AI is a strategic growth investment.

Security of US Financial System and data

1. End-to-End Encryption

Botphonic protects the customer data at each call point. Information is coded when it is in motion and when it is in rest. This will ensure that financial data is not stolen and that it is not accessed by unauthorized personnel. Customers can have a conversation on the phone without any reservations, better still because their information is secure at any given time.

2. Safety of Call Logging and Storage.

All calls are saved and stored by Botphonic in a secure environment. These call logs would help teams to look back in the past and do follow-up with the customers as well as provide transparency in the audit. Solid logging is also beneficial in terms of compliance checks and building long-term confidence with the regulators and customers.

3. SOC 2 Type II Compliance

Botphonic is SOC 2 Type II compliant, which is design to provide security, availability and data confidentiality. Such adherence indicates that the platform complies with high regulations that financial services require on the management of sensitive information of customers.the high

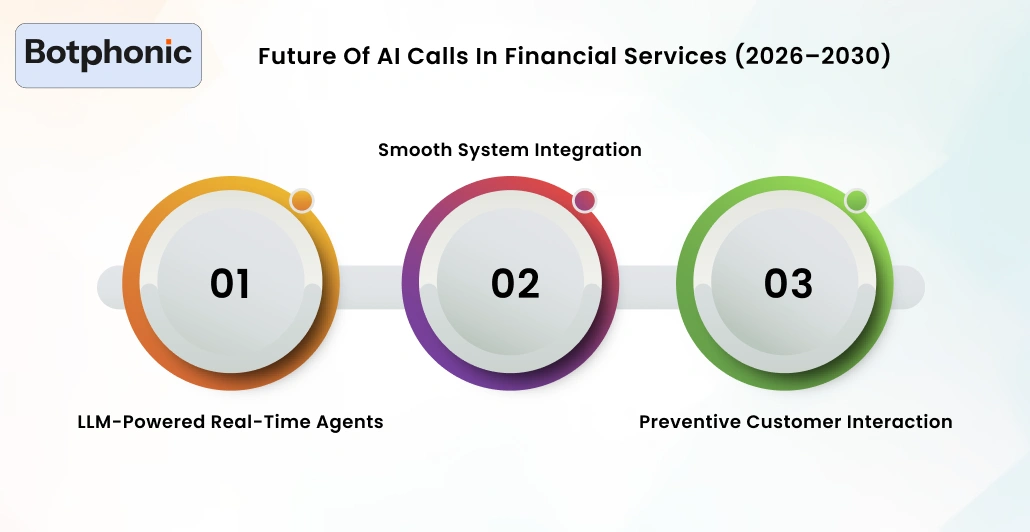

Future of AI Calls in Financial Services (2026–2030)

1. LLM-Powered Real-Time Agents

Very soon, next-level algorithms will allow conducting sophisticated banking communication in real-time. These AI agents are able to understand context, answer certain questions and give personal advice without human involvement. Your customers are given more refine and speedy customer support on each and every call.

2. Smooth system integration

Voice AI will be involve in communication with CRMs, core banking and fintech applications. To the customers this will imply real-time updates and support within all channels. The teams will also be in a single location of the customer view of actions.

3. Preventive Customer Interaction

AI will not wait to get a phone call when the customer is nonexistent. It will anticipate needs through account monitoring and account behavior. It will actively send security fraud alerts, loan prompts and payment reminders prior to customers requesting the same, which will elevate the level of satisfaction and further intensify loyalty.

Final Thoughts

The automation of AI calls is turning the way U.S. banks make calls to the customers. Improving speed, accuracy and consistency in all transactions. With the help of an AI call assistant, banks and fintechs will have the opportunity to save time in the queue and process regular calls safely and attentively while being available day and night.

The teams that rely on the services like Botphonic reduce costs, make customers happier, and do not break serious U.S. regulations. As the customer expectation increases, an AI call assistant has ceased being a technical upgrade. An impactful approach to delivering reliable, trusted and future-proofed financial experiences.