- Secure and Compliant Voice Automation

Secure AI Voice Automation for Financial & Professional Services in the U.S.

Financial and professional service firms in the United States operate under zero-margin-for-error conditions. Our voice AI agents automate client calls, verifications, reminders, and follow-ups. This allows firms to scale communication efficiently without sacrificing trust, accuracy, or compliance.

TCPA & FCC aligned

Consent & opt-in management

Audit-ready call logs

What Is AI Healthcare Communication Automation?

AI voice automation for financial and professional services is the use of controlled, rule-driven voice AI to manage regulated client communications at scale. It uses secure, compliant voice AI to handle client communications, such as verification, reminders, disclosures, and follow-ups. While maintaining regulatory and data-privacy standards.

Key Outcomes

- Fewer manual calls

- Consistent disclosures

- Better compliance tracking

- Improved client experience

Why Financial & Professional Firms Need Voice AI

There are certain rules that must be followed in financial and professional firms, clients call should comply with predefined rules, capture consent, deliver mandated disclosures, and produce defensible records. In regulated U.S. industries, every call must be accurate, consented, and traceable.

Where AI Automates Finance Client Communication

In financial and professional services, automation only belongs where processes are repeatable and regulated. Botphonic’s AI automation is applied knowingly to enhance client communication workflows that require timing precision, consistency, and full compliance.

| Workflow | Value |

|---|---|

Identity & Account Verification | Executes routine identity and account verification with predefined rules, prompts, and escalation logic; fully documented for audit compliance. |

Payment & Premium Reminders | Delivers timely reminders for payments or premiums using approved language while respecting consent and opt-out requirements; improves collection rates. |

Policy Updates & Renewals | Communicates policy changes and renewal notices accurately and on schedule; ensures standardized messaging and proof of client notification. |

Appointment & Consultation Scheduling | Confirms, schedules, and reschedules appointments automatically; reduces no-shows and improves staff efficiency while maintaining full records. |

Compliance Disclosures | Delivers mandatory disclosures verbatim and logs confirmations for regulatory audits; eliminates human error or omission. |

Post-Interaction Confirmations | Provides clients with summaries of completed actions, next steps, and deadlines; creates a documented record to reduce disputes. |

Collections (Consent-Based) | Executes collection calls strictly within consent boundaries; enforces regulatory compliance while protecting revenue and client trust. |

Try Your AI Customer Service Agent Now

Discover how Botphonic AI automation has helped businesses across industries achieve measurable success.

AI Voice Automation Across Financial & Professional Industries

AI voice automation is helping the finance industry by enhancing client communications, while reducing regulatory risks.

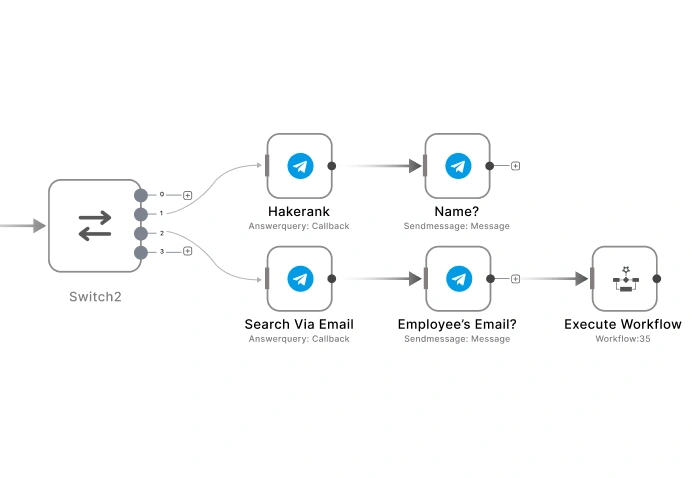

How Botphonic Secure Voice AI Works

Client Receives Or Initiates Call

The client either answers an AI-initiated call or places a call to the system, triggering the workflow.

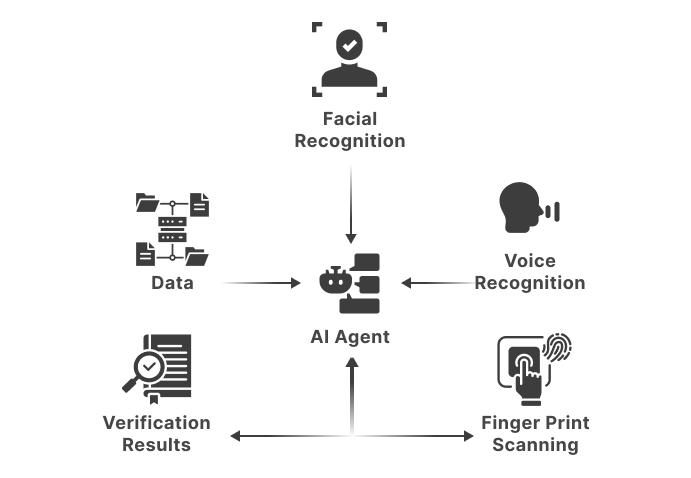

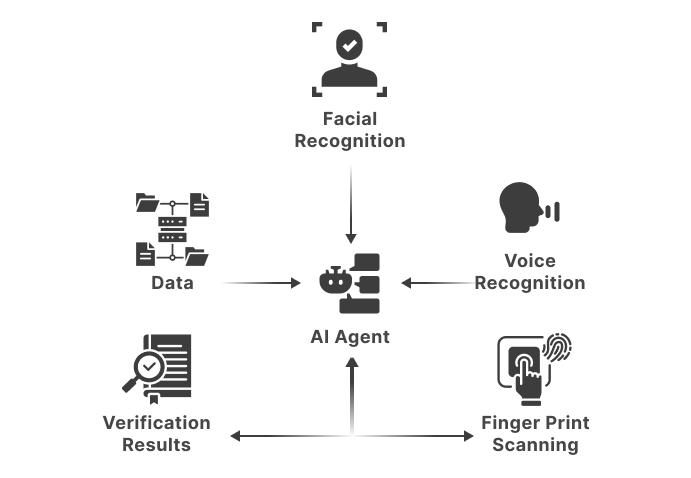

AI Verifies Identity (Per Rules)

The AI then confirms the client’s identity using predefined verification protocols, ensuring secure access.

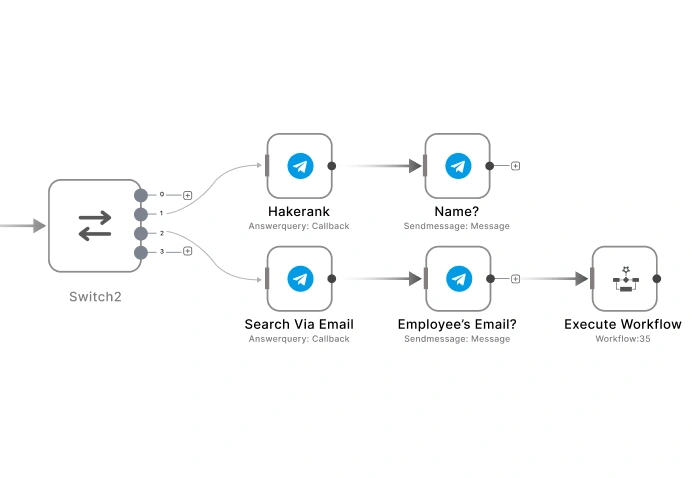

Executes Consented Workflow

Actions that are explicitly consented by the clients are executed while maintaining stric adherence to TCPA and other requirements.

Delivers Compliant Disclosures

Creates a record based on disclosures presented to the client in correct sequence, while meeting legal and audit standards.

Completes Or Escalates Interaction

If AI is able to complete the automated workflow, it does, otherwise the call is escalated to human agent with full context.

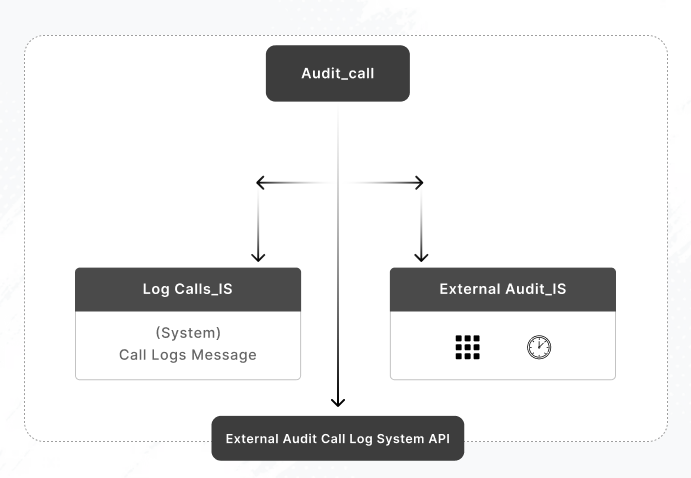

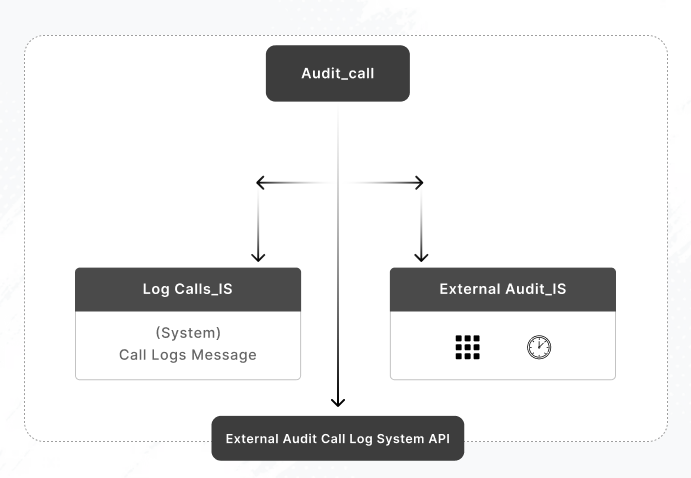

Stores Call Logs & Audit Trail

Every call, action, and disclosure is logged securely, while creating a comprehensive audit trail for compliance and reporting purposes.

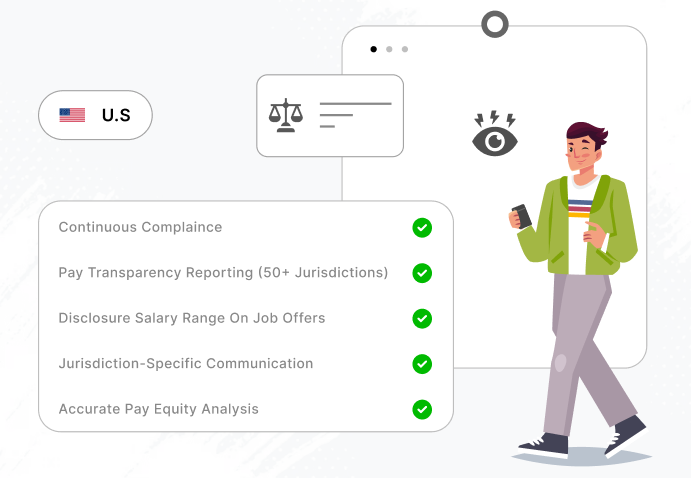

Regulatory Compliance & Governance

- TCPA Consent & Opt-Out Handling : AI interactions capture, verify, and honor client consent in real-time, opt-out requests are enforced and every consent event is logged

- FCC Call Regulations : AI calling workflows adhere to FCC guidelines, including caller ID requirements and automated dialing limitations.

- Call Recording Controls : Organizations can easily configure call recordings based on interaction type, regulatory requirements, and automated dialing limitations.

- Role-Bases Access : Access to the system is restricted by role, and ensures that only authorized personnel can initiate calls, access sensitive data, or review audit logs.

- Audit Logs and Reporting : Every action, disclosure, and client interaction is logged autonomously offering comprehensive reporting enabling compliance teams to review activity.

- U.S. Data Residency : Botphonic stores all call data, recordings, and logs on U.S. based infrastructure, ensuring compliance with federal and state regulations.

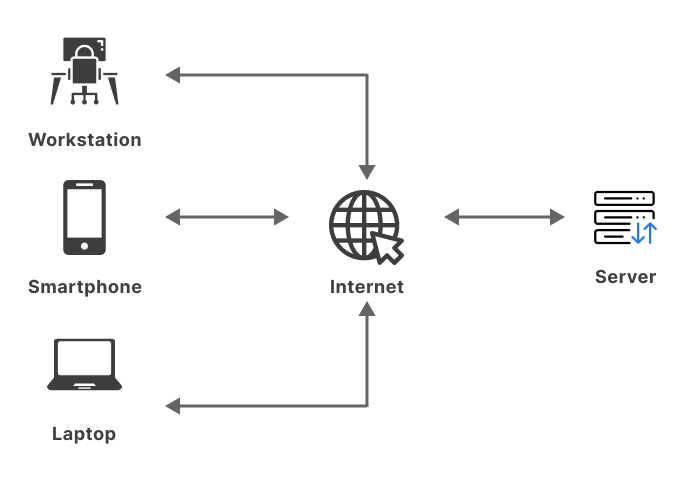

Seamless Integrations for Financial Systems

Botphonic offers robust AI voice automation for U.S. financial services that integrates with the CRMs like Salesforce and HubSpot while managing policy and claims management platforms, billing systems, appointment schedulers, and secure data services.

See all integrations

Ask Us Anything

AI voice automation uses rule-driven AI to manage client communications. And manages tasks like verifications, reminders, disclosures, and follow-ups while ensuring U.S. regulatory standards.

Yes, AI calling is considered legal when TCPA consent, FCC regulations, and disclosure requirements are captured, enforced, and logged appropriately.

Yes, the AI system delivers disclosures verbatim, in correct sequence, and smartly captures confirmation to satisfy regulatory requirements and audit readiness.

Yes, all interactions, metadata, and recordings are securely stored in compliance with U.S. data residency rules, while creating a complete audit trail.

Consent is recorded, verified, and enforced for all calls. And also real-time opt-outs are respected and all consent actions are logged for compliance auditing.

Yes, Botphonic integrates with major CRMs, billing, appointment, and policy and claim systems, while ensuring seamless workflow synchronization.

Most U.S. firms deploy in weeks depending on internal compliance review cycles and integration complexity.

Yes, every integration is logged, consented, and traceable, providing compliance teams with quick access to audit-ready records.

Compliance Questions? We’ve Got Answers

Check How Botphonic Handles Tcpa Consent, Fcc Regulations, Secure Integrations, And Audit-Ready Reporting.