Streamlining Insurance Workflow With The AI Personal Assistant

Adopting the AI personal assistant to reshape the insurance procedure. Enhancing satisfaction of policy holders to the next level. Try it now.

Transformative Gains of AI Personal Assistant in the Insurance Sector

Analyzes Risks

AI personal assistants screen each holders’ information after determining several factors and evaluate the market risks.

Expand Insurance Service

Receiving and dialing number of calls, beyond the capacity of human agents. Swiftly interact with international customers.

Personalized Connections

Respond to innumerable inquiries in the real-time and showcase the desired information that build up client trust and increase engagement.

Adopting AI voice Agent To Mitigates Your Client Wait Times

Enhance the speed of claim processing, answers in the real-time to avoid delays, and furnish precise answers.

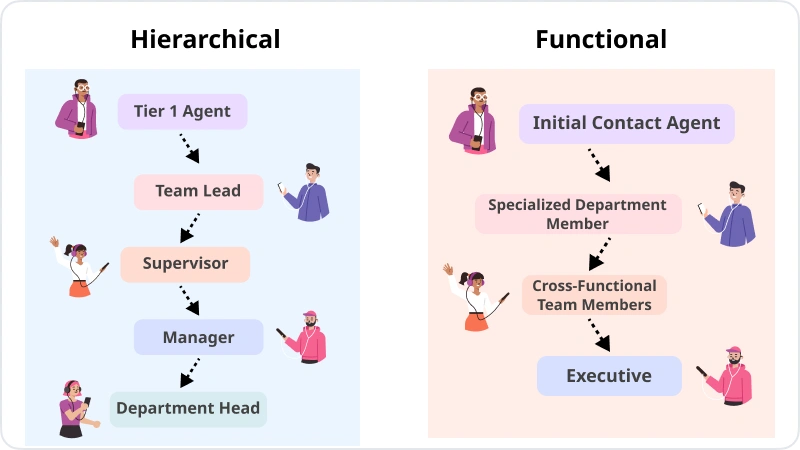

Smooth Escalation of Client Cases

Capturing the context of incoming chats or calls, processing information and response promptly. Smoothly transferring the customer inquiry to the right personnel, maximizes the client satisfaction score.

Handling Policy Information

Accessing data of each policy holder and checking it thoroughly, detecting the mistakes or missing values. Answering any of the policy related questions to customers after extracting information.

Look What Our Customers Say

Explore the incredible experience of Botphonic clients and comprehend our extensive potential. We assist you in attracting more clients and improving operational speed.

"Botphonic has completely transformed our customer service experience. Their AI Call Assistant handles thousands of calls daily with a human-like touch, making interactions smooth and natural."

"I was amazed at how real the conversations sound. Our clients often can’t even tell they’re speaking to an AI! Botphonic’s 24/7 availability and real-time guidance have helped us boost customer satisfaction and reduce workload significantly."

"The best part about Botphonic is the human-like voice quality and seamless handling of inbound and outbound calls. It has saved us countless hours and improved our response time dramatically. Highly recommended!"

"We shifted our entire call handling process to Botphonic’s AI Call Assistant, and it’s been a game-changer. From appointment scheduling to real-time support, everything is managed efficiently without losing the human touch."

"Botphonic has helped us scale without scaling our call center team. The AI agent is smart, responsive, and truly feels like speaking to a real human. It’s reliable, fast, and available round-the-clock — exactly what we needed!"

"Thanks to Botphonic, we no longer worry about missing important calls or overwhelming our staff. The AI conversations are so natural that our clients feel genuinely heard and understood."

Ready-to-use AI Virtual Assistant For Seamless Insurance Workflow

Sophisticated AI algorithms to extract correct data, enhance policy holders experience, and minimize workforce burden.

Manage daily inquiries and address it quickly

Furnish reminders for monthly payments

Scrutinize policy holder information for delivering relevant response

Generate automates slip after collecting premium amounts

Automate the normal tasks like scheduling and creating reports

Administer customer records and update instantly after receiving data

Intuitive interface, scalable, and secure

Intelligent AI personal Assistant For Managing Policies and Instant Replies

Furnishing the relevant policies after examining the customer profile and their budgets, increasing efficiency and minimizing response time.

Increases Productivity

Drops Operational

Costs

Enhance Conversion

Rate

Ask Us Anything

Botphonic, the modern and renowned personal assistant, especially for the insurance companies. It addresses your customers inquiries without a break, improves policy information, extracts information immediately, and provides appropriate recommendations after analyzing customer profiles.

An AI personal assistant requires any marketing integration platform or access for screening personal and policy information. After getting approval, it has the capacity to add and edit policy information. Furnish correct answers to policy holders after understanding their policies and associated details.

Virtual assistants in Insurance companies create spectacular changes in the workflow from answering clients to recommend policies. Additionally, it has access to claim documents and address related requests when clients get confused about the premium amount or claim processing.

The AI voice assistant helps to notify clients about their premium dues and they can ask any questions about their policies or claims. AI ready to give all answers on time. Automates the procedure of administering policies like inspecting mistakes, updating information immediately, and providing correct information after analyzing data.

Replacing the conventional insurance procedure with the modern workflows. It is possible after purchasing the AI call assistant platform. It reshapes the policy management system, instantly addresses queries and they don’t have to stand in the long waiting lines. Additionally, it improves claim processing systems and furnishes the right information to customers.

Absolutely, the AI personal assistant platform works well for the insurance sector. Collecting the policy information and correcting the mistakes instantly after detecting through the AI algorithms. It accelerates the claim workflows, delivers fast responses, gets immediate feedback, and improves service calls.

Improving the future insurance services with the AI voice assistant. Administer and scrutinize the policy information, furnishing the relevant replies to clients. Furthermore, it resolves the most challenging tasks and addresses requests immediately. It improves routine day activities that enhances the workforce productivity.

A Policy holder, satisfies when gives them importance and addresses their inquiries immediately. Furthermore, they need the exact solution of their problem like the sequential steps of claim processing, exact policy as per their budget, and require reminders for timely payment. With the AI call assistant, you can fulfill the policy holder expectation.

AI call assistant support in faster settlement, reduces mistakes, and enhances service efficiency. It gathers new client information and recommends the exact policies after examining their data. Moreover, it manages the number of inquiries in a single day and improves interaction with the previous clients.

Yes, the AI voice assistant has the potential to examine fraudulent activities. Thanks to sophisticated algorithms. It applies on the recorded information and fetches out the wrong details and empty spaces., immediately fills these gaps with the techniques. Has features to detect spammy words after analyzing patterns of recorded information.