Summarize Content With:

Summary

AI agents are taking their critical roles in the financial sector, from trading to customer calls, compliance becomes the silent safeguard. Hence through this blog let’s understand how AI is helping the finance sector and why financial services AI calling compliance is a necessity.

Introduction

AI agents in financial services are helping institutions to change from legacy systems to intelligently automated ones. AI applications in financial services software helps providers to offer better services to customers. Amazingly, AI is at the center of the entire transformation.

AI agents are making people from Financial background shift from manual rule based tasks to intelligently automating tasks. It was previously noted that more than half of the agents at financial service institutions have to switch among screens to get their necessary information. But AI agents are filling this gap by introducing efficiency and productivity.

Through this blog we can explore how AI agents are navigating the complex landscape of finance. We will understand how they work today and regarding its regulatory compliance.

Understanding AI agents in financial services

AI call assistants in the financial sector are revolutionizing the manner in which they use automation for enhancement of customer experience. Rather than just working based on a predefined set of rules or machine learning technology, financial AI agents presently possess more autonomy.

They are capable of processing input data and carry out actions accordingly. It can flag transactions, update records and even send reminders or alerts as per the rules and goals. Also these AI agents follow security laws and compliances ensure that they operate safely and securely.

AI powered agents are softwares that are developed to analyze their environment, interpret data, make decisions and work with the mentioned goal. You can consider it as an intelligent teammate that works faster and processes data in real-time. It’s more helpful than others because:

- Constantly learns from the incoming data and stored data.

- Quickly adapts to what’s new in the market.

- Can conduct tasks freely such as trading or underwriting loans.

These artificial intelligence (AI) financial agents are built on technologies such as robotic process automation and natural language processing.

Smarter automation, zero compromises

Launch Botphonic Now.How does an AI phone assistant in finance differ from others?

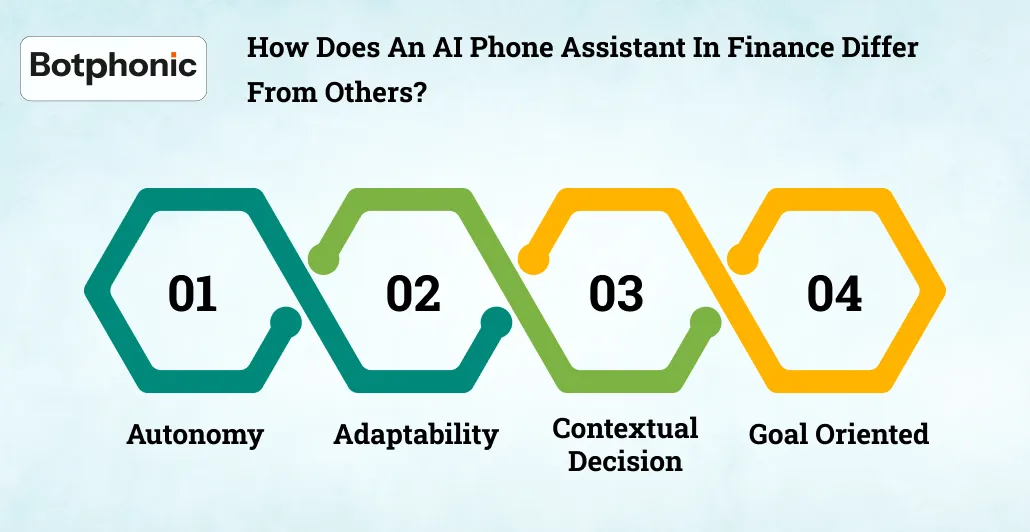

These latest autonomous models aren’t all about just upgrading the previous ones. Instead they are completely a new AI agent model. Here’s what sets it apart:

- Autonomy: Earlier to operate rule based systems you had to provide explicit instructions. But with new AI agents they can work freely in the guardrails that your organisation specifies.

- Adaptability: AI agents keep on evolving depending on the data. Hence they can respond to market changes or even regulatory changes.

- Contextual decision: These agents now make choices depending on the context and previous patterns rather than static logic trees.

- Goal oriented: AI agents are trained to stick to the task or goal. Hence if you specify to maximise ROI or to maintain strict compliance it will follow the same.

For instance if you see a traditional fraud detection system it will identify frauds as per fixed rules. On the other hand AI agents will analyse the context of the transaction and decide whether to pass, flag or escalate. Hence they are necessary in this dynamic financial environment.

Why is financial services AI calling compliance necessary?

The finance sector is dynamic and its rules constantly keep changing. Here’s why compliance is necessary while using AI agents:

- Financial calls generally consist of sensitive data such as account details, personal information and transactions.

- Fines, legal action, and even license revocation may follow noncompliance with these regulations.

- Customers feel protected when they know calls are secure and regulated.

- Compliance avoids cases of biases in loans, credit score and customer service.

- Creates audit trails along with records to ensure transparency.

How to comply with AI calling regulations in financial services?

Here are some ways in which you can maintain the integrity of your financial institutions while using AI agents:

- Use certified platforms like Botphonic AI that are built with GDPR, PCI DSS and other compliance in mind.

- Make sure to encrypt all data including call recordings, transcripts, and customer details.

- Always make sure you inform customers about recordings and monitoring data use.

- Regularly train your system to adjust to changes in regulations.

- Keep audit trials and carry out compliance checks on AI calls.

- Make sure that AI hands complex and sensitive cases to the human agents.

Top use cases of AI agents in finance

AI agents are dealing with the behind the scenes of operations which are positively impacting customer interactions. Its ability to learn based on data and work independently is creating a measurable difference. Here are the ways in which these AI agents are helpful in finance sector:

1. Fraud detection and prevention

One of the most beneficial uses of AI in the financial sector is detecting fraud and preventing them. These agents watch how transactions are carried out so that they could detect any suspicious pattern and stop it immediately. It is capable of flagging any abnormalities or blocking such activity which is not possible with static or manual reviews.

Almost 77% of people admit that they want AI that prevents and detects fraud. By continuously learning with the help of data, it stays ahead of any fraud emerging in the financial landscape. Hence it builds relationships with customers by reducing their losses.

2. Algorithm based autonomous trading

The landscape of finance is dynamic, speed and ability to adapt is must for it. AI agents, including advanced AI trading Bot, are now being used to provide algorithm-based trading. These systems scan huge amounts of market data to spot opportunities and conduct trades smoothly.

It helps companies remain agile even in the volatile environment. No need for human input now to alter strategies. Hence it results in faster execution with no human errors.

3. Personalized advice

Financial organizations are now able to offer their clients individualized advice thanks to AI. By referring to individual client goals, their history and market situation, an AI agent can provide them with a smart investment plan.

These kinds of extremely personalized services were only available to high-end clients. But now these AI agents are making it accessible for all. It is an exceptional shift that helps people make mindful decisions.

4. Customer service

AI agents are managing customer services for plenty of niches. For finance they can answer questions like balance and guide them for onboarding. They can also help users in solving questions related to accounts. These AI agents understand context and try to provide responses aptly. But in any case if they fail to do so, they escalate calls to human agents.

AI agents can be used by financial organizations to improve customer service and resolve issues more quickly. And for customers it means having 24/7 assistance for financial matters.

5. Credit scoring and risk assessment

The former credit scoring is known to use only a limited amount of data. Rather, AI agents produced more comprehensive and accurate evaluations by using more data. They have a view of transaction history, employee record and even behaviour.

It also facilitates faster decisions on lending money on mortgage. Hence it makes credit available for individuals that traditional systems might overlook.

6. Loan underwriting and approval

AI agents are also beneficial while processing loans. They collect and analyze the data of applicants and generate risk scores. It even lessens the workload on human agents and lets lenders move fast.

Additionally it can eliminate chances of human errors. And for customers it can mean faster loan approval and transparent decisions. And for financial services providers it means better consistency and ease of workload.

Conclusion

AI agents are growing to be an essential partner in providing faster and more personalized financial services. From introducing automation in the back end office to providing an exceptional customer experience, it could help institutions do more with less staff and cost. Hence it raises the standards of innovation and accuracy.

As AI agents are growing more advanced they are moving towards unlocking new possibilities in each sector. But along with this it is necessary that they comply with regulations majorly for the finance sector. Choose a right partner like Botphonic AI for your call assistant and never worry about compliance.